On Tuesday, the Office of the Special Inspector General charged with auditing the government’s Troubled Asset Relief Program (TARP), which bailed out among others General Motor and the Chrysler Group, came out with a report criticizing the U.S. government for failing to implement salary caps.

To brief you up, back in 2008, the U.S. government used US$700 billion under Tarp to bailout more than 700 institutions from which seven companies stood out due to the amount of money they received and the nature of their bailouts.

The seven companies that received so-called “exceptional assistance” were General Motors, the Chrysler Group, Ally Financial (formerly GMAC, Inc.), AIG, Bank of America, Chrysler Financial Services and Citigroup.

The seven companies that received so-called “exceptional assistance” were General Motors, the Chrysler Group, Ally Financial (formerly GMAC, Inc.), AIG, Bank of America, Chrysler Financial Services and Citigroup.

Although using taxpayers’ money to bailout privately owned institutions was an issue debated for a long time, as it turns out, saving those companies and thousands of American jobs was not the only issue on hand.

In February of 2009, President Barack Obama announced a $500,000 annual salary cap at companies that had received “exceptional assistance” under TARP, with any further compensation to be paid in stock that could not be cashed in until the company paid back TARP.

According to the audit, the government failed to implement these restrictions because it simply cared about getting its money back.

“In proposing high pay packages based on historical pay prior to their bailout, the TARP companies failed to take into account the exceptional situation they had gotten themselves into that necessitated taxpayer bailout,” said the report.

Special Master Feinberg said that the companies pressured him to let the companies pay executives enough to keep them from quitting, and that Treasury officials pressured him to let the companies pay executives enough to keep the companies competitive and on track to repay TARP funds.

The report adds that Ken Feinberg, the first pay czar, said, “the companies pressured him to let them pay executives from keep them from quitting and the Treasury officials pressured him to let the companies competitive and on track to repay TARP refunds.”

The Treasury Department replied that the average cash compensation for the 25 top executives was cut by more than 90 percent and their total compensation by more than 50 percent.

According to the Detroit News, North America President Mark Reuss recently told reporters that salary restrictions are a real burden and he is concerned that GM will lose top talent to other automakers if they are not lifted.

The Detroit news site also added a quote from GM’s Chairman and CEO Dan Akerson from an interview with CTV: “I’m probably in the bottom 10 percent of CEOs. The government actually wanted to give me a raise, but I said, ‘I can’t do that’.”

Quite commendable, don’t you agree? Unless, of course, you take into consideration that Akerson’s annual compensation is no less than US$9 million, including $1.5 million in cash…

Detroit-based auto and mortgage lender Ally Financial Inc. (formerly GMAC, Inc.) received a US$17.2 billion bailout, with the Treasury Department currently owning 74 percent of the company. The pay czar approved a US$9.5 million pay for its CEO, Michael Carpenter.

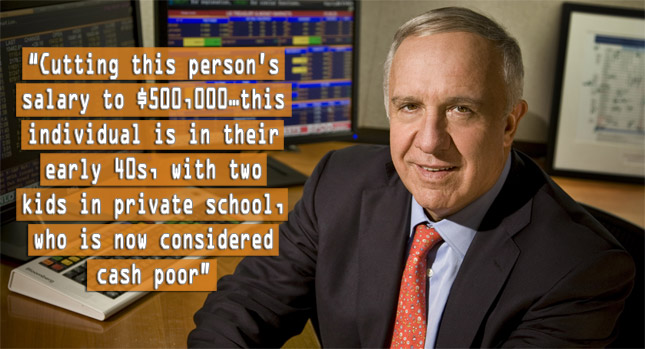

Carpenter insisted that the $500,000 annual cash salary limit by the government was constraining.

“We had an individual who was making $1.5 million total compensation with $1 million in cash. Cutting this person’s salary to $500,000…this individual is in their early 40s, with two kids in private school, who is now considered cash poor,” Carpenter told the auditors.

“The reduction in monthly cash expenses would take at least two years to monetize value via stock salary…We were concerned that these people would not meet their monthly expenses due to the reduction in cash,” he added.

We really sympathize with those “cash poor” execs who earn only half-a-million bucks each year. It makes us wonder how they manage to make a living, really…

Scroll down to read the entire report.

SIGTARP AUDIT