According to Bankrate’s latest Car Affordability Study, the average American living in a large city doesn’t earn enough to purchase a new vehicle.

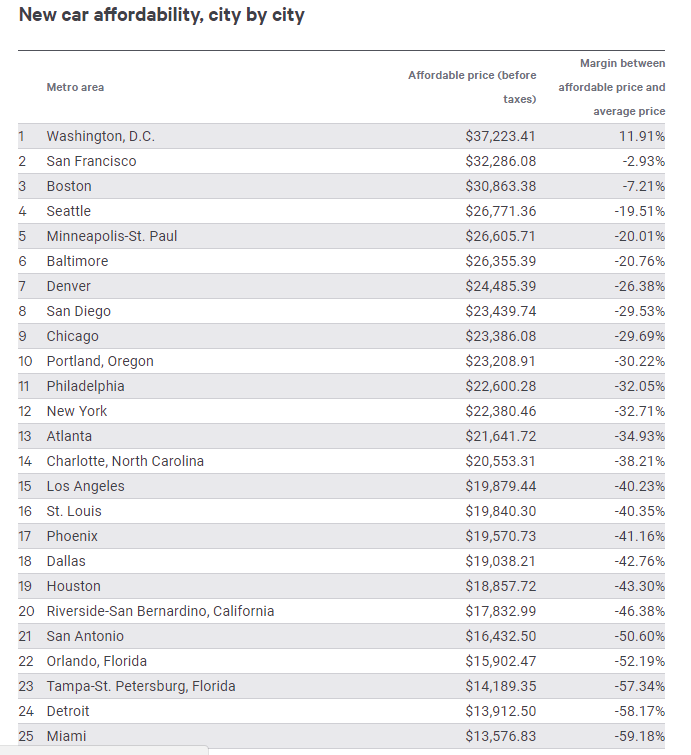

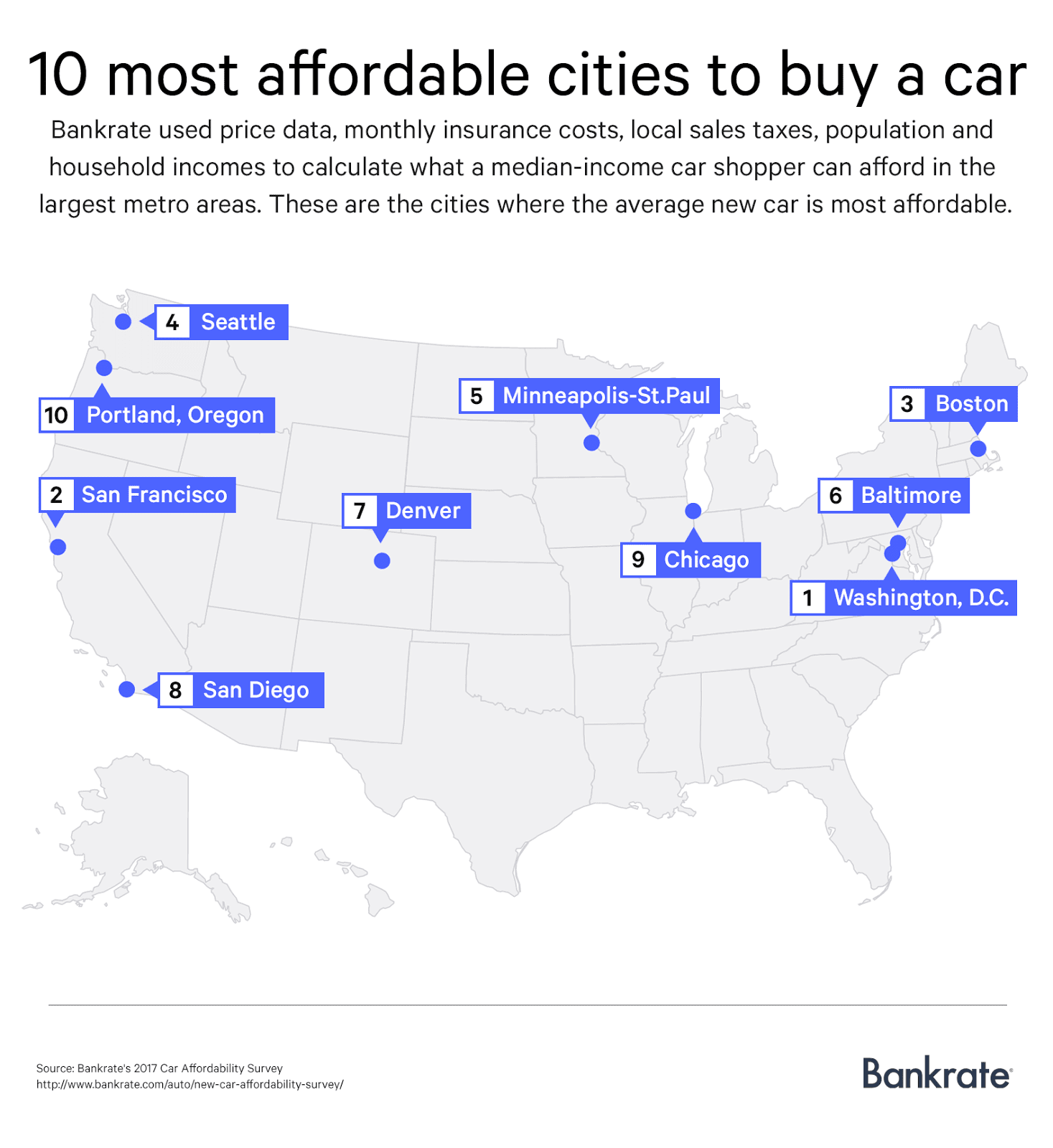

The study looked at a variety of different factors including vehicle pricing data, monthly insurance costs, local sales taxes, and household incomes in 25 cities in the United States.

The study also used the so-called “20/4/10” rule which states buyers should “put down at least 20 percent of a vehicle’s purchase price, take out a car loan for no longer than four years, and devote no more than 10 percent of your annual income to car payments, interest, and insurance.”

According to the results of the study, Washington D.C., San Francisco, and Boston are the three cities in the United States where residents are most likely to be able to afford a new vehicle. Likewise, the cities of Miami, Detroit, and Tampa-St. Petersburg were the places where car ownership was most likely to be out of reach for a majority of people.

Even though used car prices are dropping, the study found people living in the eight of the 25 cities would have trouble buying at vehicle at the current average used-car price of around $19,200.

The news is somewhat surprising but Autotrader senior analyst Michelle Krebs explained “In the past 35 years, the cost of a new car has gone up 35 percent, a used car is up 25 percent, and at the same time, the median household income is only up 3 percent.”

The study says the affordability issue is pushing consumers to flock towards longer term loans. As we reported earlier this month, the number of new car loans between 73 and 84 months has shot up from 11.7 percent in early 2009 to 33.8 percent this year.