This week was a big one for Faraday Future, which has spent most of its existence without much of a future.

However, that’s all set to change as the company went public on the NASDAQ yesterday.

Trading under the FFIE ticker symbol, Faraday Future is the latest EV stock to go public via a special purpose acquisition company. That being said, the reaction on Wall Street has been muted as the stock sits at $14.82 per share which is slightly above its starting price.

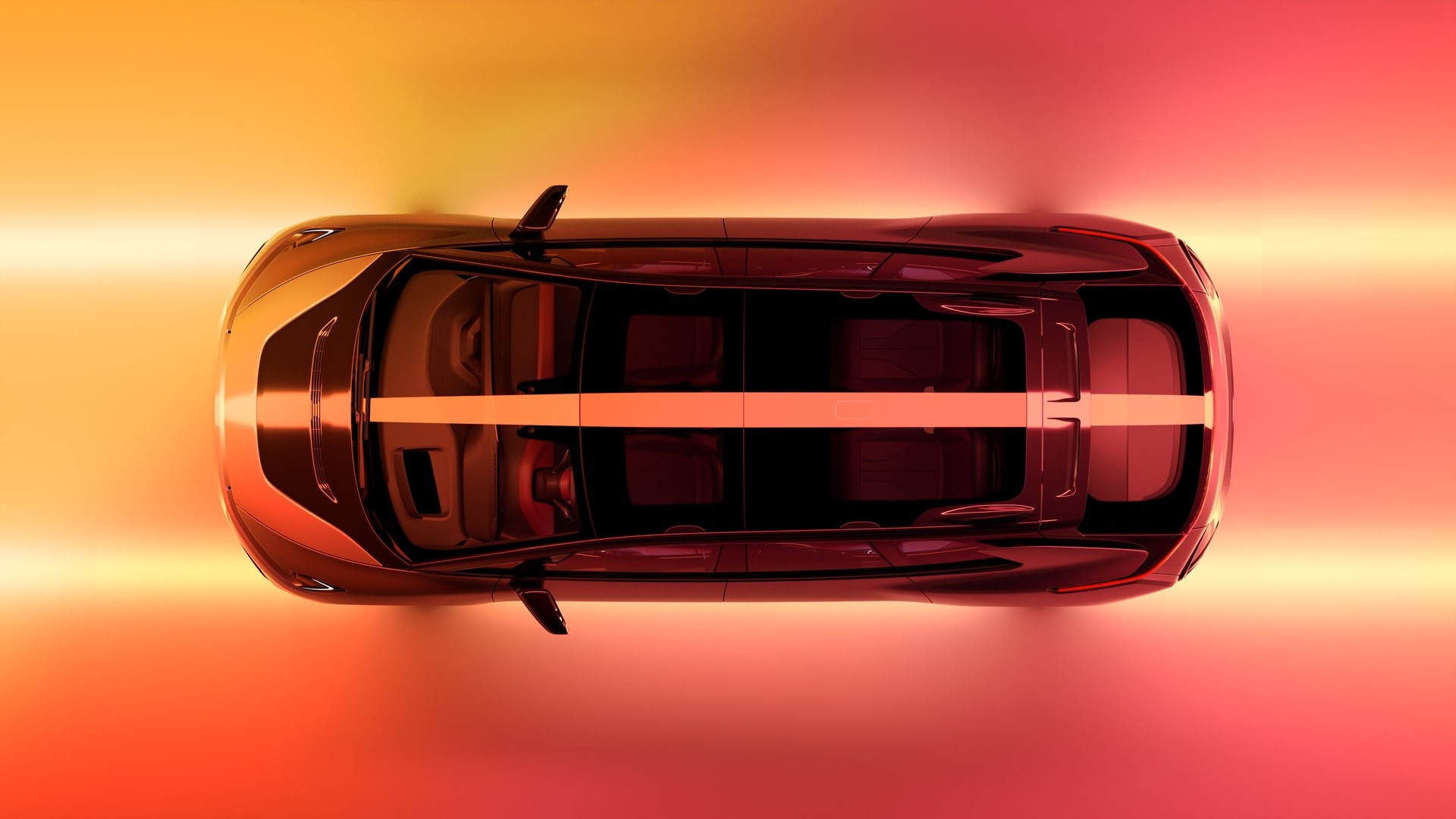

Also Read: Faraday Future’s FF 91 Has 1,050 HP And Hits 60 MPH In 2.39 Seconds

While that’s notable by itself, the big news is that Faraday Future secured approximately $1 billion (£727 / €849) through its combination with Property Solutions Acquisition Corp. The company believes this should provide them with enough funding to begin delivering the oft-delayed FF 91 within the next 12 months.

Furthermore, Faraday Future announced the invite-only FF 91 Futurist Alliance Edition will be limited to 300 units which can be secured with a reservation deposit of $5,000. Buyers will be among the first FF 91 owners and they’ll receive a handful of privileges including “Futurist Alliance membership, Spire Club membership, and the next generation product upgrade privileges.” The model is slated to run from 0-60 mph (0-96 km/h) in 2.4 seconds, thanks to its tri-motor powertrain producing 1,050 hp (783 kW / 1,065 PS).

Faraday Future CEO Dr. Carsten Breitfeld said the listing marks a new chapter in the company’s history and is the culmination of seven years of work. He added, “We would like to thank all investors, partners and internal and external partners for their trust and confidence in our leadership, product technology and business model, and we are confident in the high-quality delivery of our FF 91 Futurist in the next 12 months.”