- Ford had a disappointing 2025 as their bet on EVs backfired.

- Booked billions in special charges related to failed projects.

- Tariffs and supplier fires also weighed heavily on the automaker.

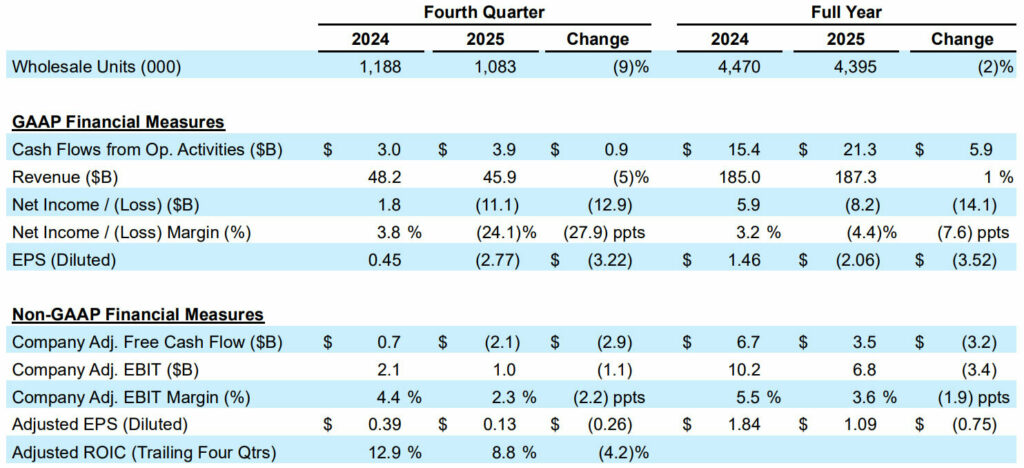

Ford has revealed their fourth quarter and full year 2025 financial results, and they’re a doozy. While officials tried to sugar coat things, there’s no hiding an $8.2 billion net loss for the full year, the company’s largest since the 2008 financial crisis, also known as the Great Recession. This compares to a net profit of $5.9 billion the prior year and it came despite revenues of $187.3 billion.

The company was dragged down by an $11.1 billion net loss in the fourth quarter, as well as lackluster demand for electric vehicles. Ford’s Model e division reported a full-year EBIT loss of $4.8 billion, although they noted it was an improvement compared to 2024.

More: Ford Kills The F-150 Lightning And Proves Ram Had The Right Idea

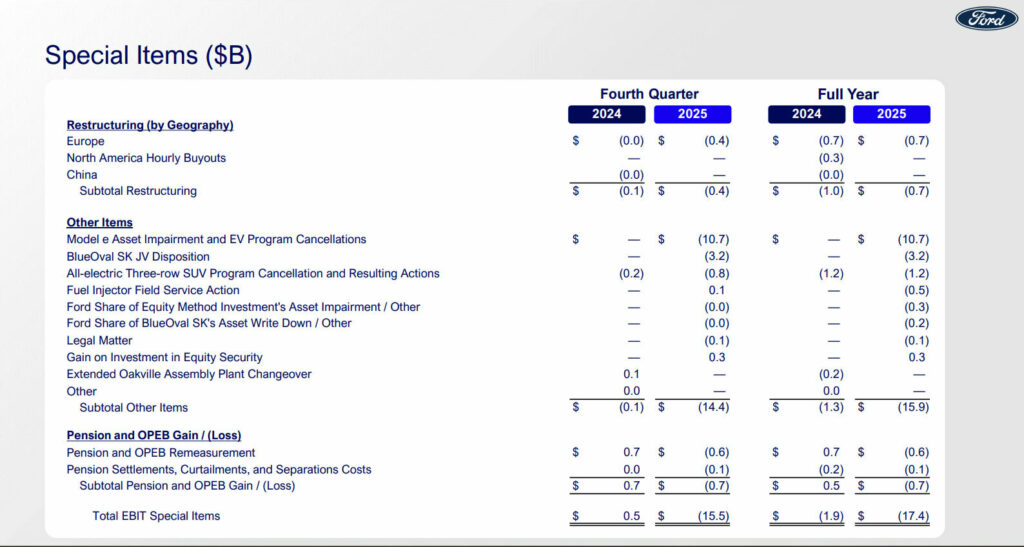

EVs weighed heavily on the automaker last year as they booked a $10.7 billion special charge for “Model e Asset Impairment and EV Program Cancellations.” Another $1.2 billion was wasted on cancelled three-row EVs, while $3.2 billion went to the BlueOval SK joint venture disposition. The company also spent around $500 million on a fuel injector recall.

While EVs were front and center as Ford recently killed the fully electric F-150 Lightning, they weren’t the company’s only problem. Far from it as the automaker got hammered by tariffs as well as fallout from the Novelis fires. The latter impacted supplies of aluminum, which hampered F-150 production.

For the year, the company posted an adjusted EBIT of $6.8 billion, which was down from $10.2 billion in 2024. Adjusted earnings per share also fell from $1.84 to $1.09.

CEO Jim Farley said, “Ford delivered a strong 2025 in a dynamic and often volatile environment. We improved our core business and execution, made significant progress in the areas of the business we control – lowering material and warranty costs and making real progress on quality – and made difficult but critical strategic decisions that set us up for a stronger future.”

Speaking of which, the company is expecting an adjusted EBIT of between $8 and $10 billion for 2026. The automaker is also expecting to lose $4 to $4.5 billion on Ford e.

On top of that, we can expect special charges of around $7 billion in 2026 and 2027 due to their “updated EV strategy and expected disposition of BOSK [BlueOval SK] investment.”