- New growth hotspots emerged far outside traditional markets.

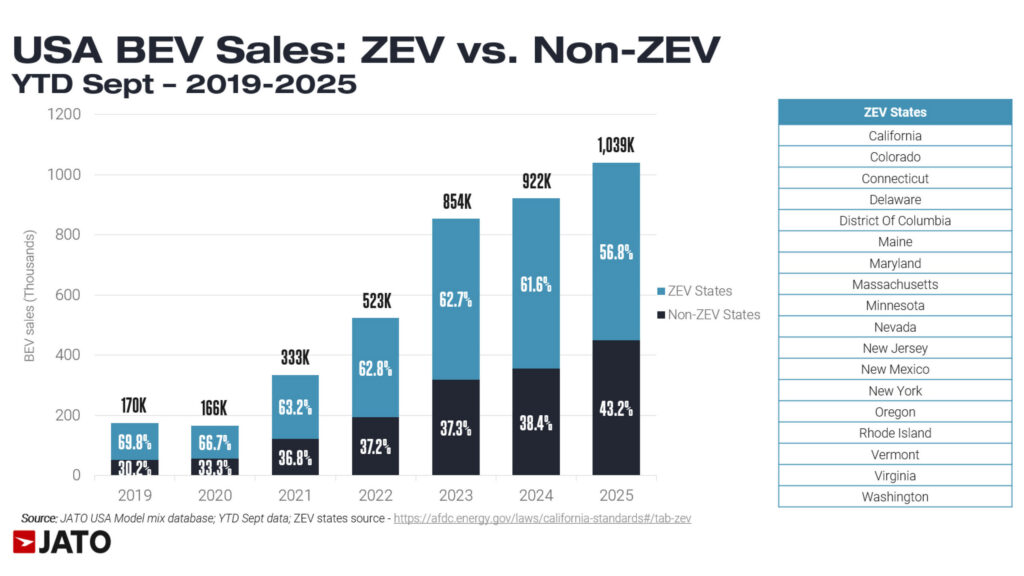

- A major federal incentive ended late in the calendar year.

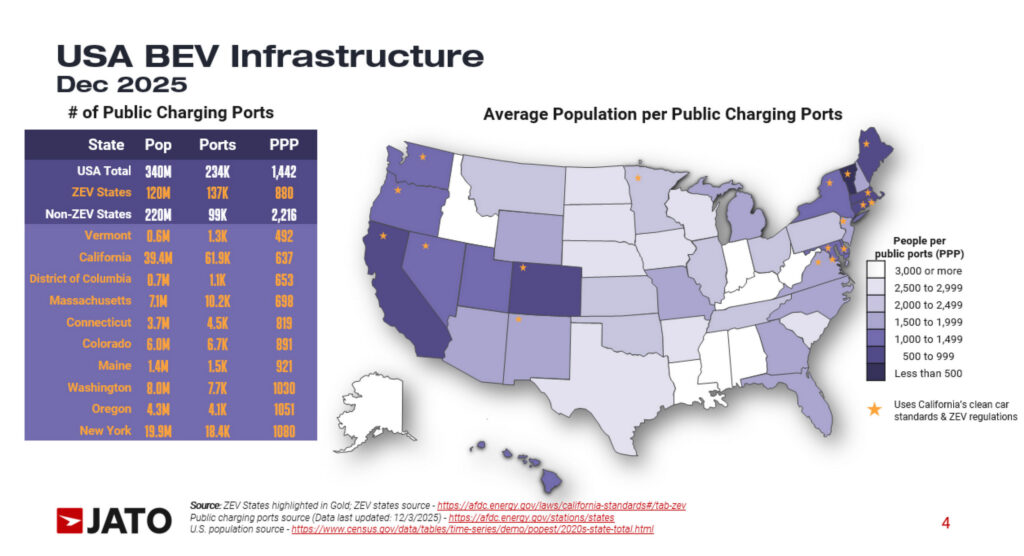

- Charging access still varies widely across state lines.

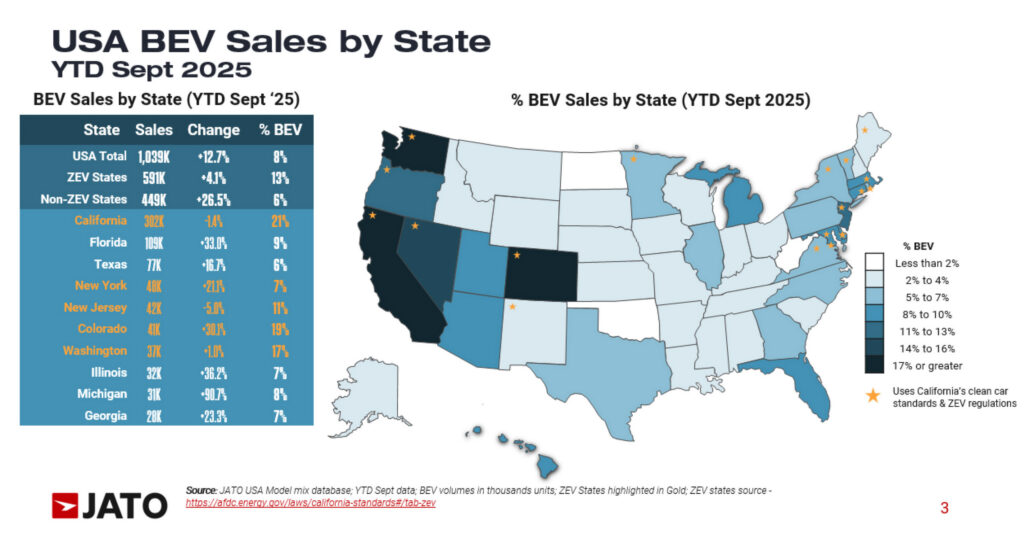

After years of leading the national shift toward electric vehicles, California may be approaching an inflection point. For the first time since the pandemic, EV sales in the state are expected to dip in 2025, even as several other states report a sharp rise in adoption.

Read: California Has A New Way To Make EV Owners Pay

Data from JATO Dynamics shows that during the first nine months of 2025, before the federal EV tax credit ended, roughly 302,000 electric vehicles were sold in California. That figure represents a 1.4 percent decrease compared to the same period last year, hinting that the state’s EV market could be nearing saturation.

We don’t have figures for the last quarter of the year, but given the elimination of the $7,500 federal tax credit on September 30, it’s safe to assume the final numbers will look worse, unless buyers suddenly developed a taste for paying more.

Despite this, California remains well ahead of the pack. EVs now account for 21 percent of new vehicle sales in the state, placing it above the District of Columbia (19 percent), Colorado (19 percent), Washington (17 percent), Nevada (16 percent), and Oregon (13 percent).

ZEV States Surge

Several of these ZEV states saw marked gains last year. For example, New York’s EV sales rose 21.1 percent in the first three quarters, while Colorado posted a 30.1 percent increase. On average, EVs make up 13 percent of new car sales in ZEV states. In contrast, non-ZEV states average just 6 percent, contributing to a national average of 8 percent.

EV sales also rose sharply in many non-ZEV states during the same period. Florida, in particular, recorded an impressive 33 percent jump between January and September 2025, reaching 109,000 units, which now represent 9 percent of new vehicle sales.

That jump in Florida is notable not only for its scale, but also because it comes without the backing of ZEV mandates or aggressive state-level incentives. In a politically conservative state where environmental policy isn’t front and center, the increase suggests that consumer demand, not legislation, is doing the heavy lifting.

Texas followed with a 16.7 percent rise to 77,000 units. Illinois saw a 36.2 percent increase, reaching 32,000. Georgia posted a 23.3 percent bump to 28,000, while Michigan led in growth rate, soaring 90.7 percent to 31,000 EVs sold.

“The rapid uptake in BEV sales in Michigan is a clear example of why growth in traditionally non-ZEV states presents such a valuable opportunity for domestic brands,” JATO analysis and reporting specialist Anthony Puhl said.

“While it is possible for a brand to break into a new market, as Tesla has done on a national level, we expect BEV sales in other states to come from brands with which the population is already familiar.”

One of the key hurdles for EV adoption in non-ZEV states remains charging infrastructure. In ZEV states, there’s approximately one public charging point for every 880 people. In non-ZEV states, that number jumps significantly to one for every 2,216 people, highlighting a critical gap in support systems for EV owners.