- Stellantis has announced they’re ‘resetting’ their business.

- Company is dialing back on EVs and embracing choice.

- Expects to lose up to $24.8 billion in second half of 2025.

Following the ouster of Carlos Tavares, Stellantis has been making big changes. As part of the shakeup, the company killed plug-in hybrids in North America and axed the fully electric Ram 1500 REV. Ram also brought back the 5.7-liter Hemi V8 and the supercharged 6.2-liter V8 in the TRX.

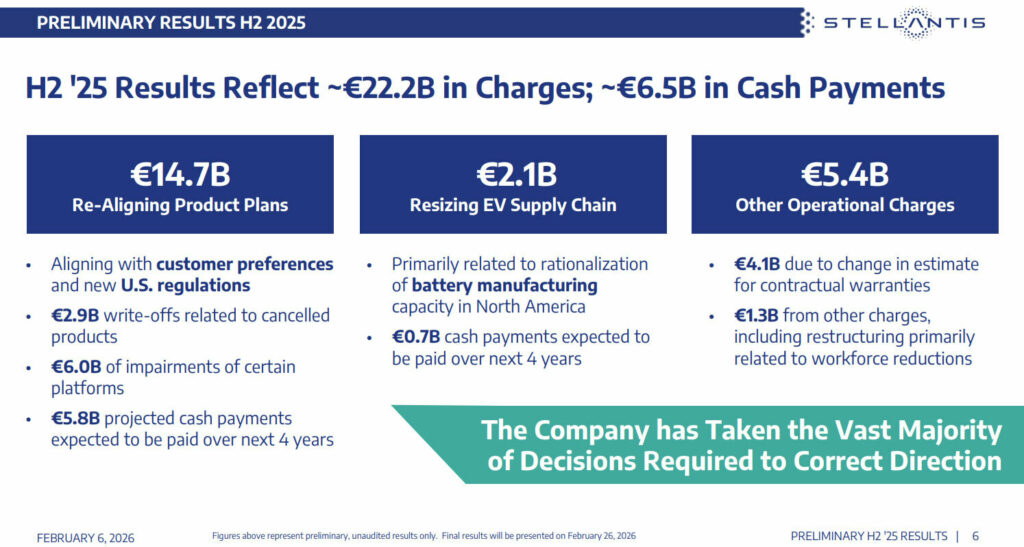

These are notable developments and they’re costing Stellantis a fortune. In particular, the automaker announced a $26.2 (€22.2) billion charge that is primarily related to their shift towards “freedom of choice.” This effectively means consumers can choose the powertrain of their liking as the company will offer internal combustion engines, hybrids, and EVs.

More: Stellantis Quietly Kills Its Plug-In Hybrids In America

The revelation was part of a larger announcement, where the company revealed a “reset of its business.” We’ll learn more during Stellantis’ Investor Day event on May 21, but the automaker is dialing back on EVs as the “pace … needs to be governed by demand rather than command.”

CEO Antonio Filosa said, “The reset we have announced today is part of the decisive process we started in 2025, to once again make our customers and their preferences our guiding star.” He added the massive charges “largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires.”

Filosa also slammed his predecessor as he noted the “impact of previous poor operational execution, the effects of which are being progressively addressed by our new team.”

Breaking Down The Numbers

Stellantis said $17.4 (€14.7) billion was due to re-aligning product plans with customer preferences and new emission regulations in the United States. It also reflects “significantly reduced expectations for BEV products.” Speaking of which, the company is writing off $3.4 (€2.9) billion related to cancelled projects.

Stellantis is also taking a $2.5 (€2.1) billion hit to “resize” their EV supply chain, while $6.4 (€5.4) billion is from other changes in the company’s operations such as workforce reductions in Europe.

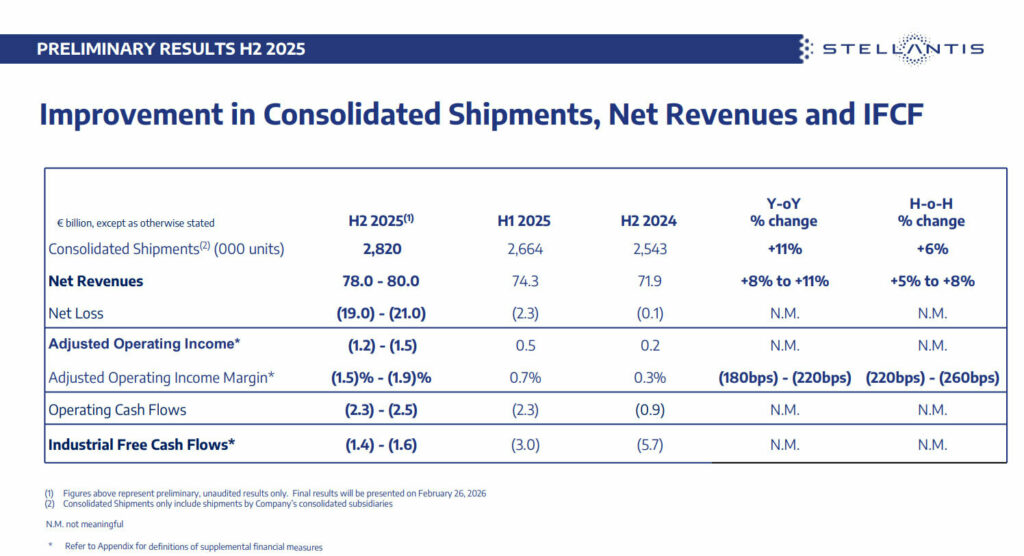

For the second half of 2025, the company expects revenues of $92.2 – $94.6 (€78 – €80) billion. While that sounds pretty good, the company is expecting a net loss of $22.4 – $24.8 (€19 – €21) billion.

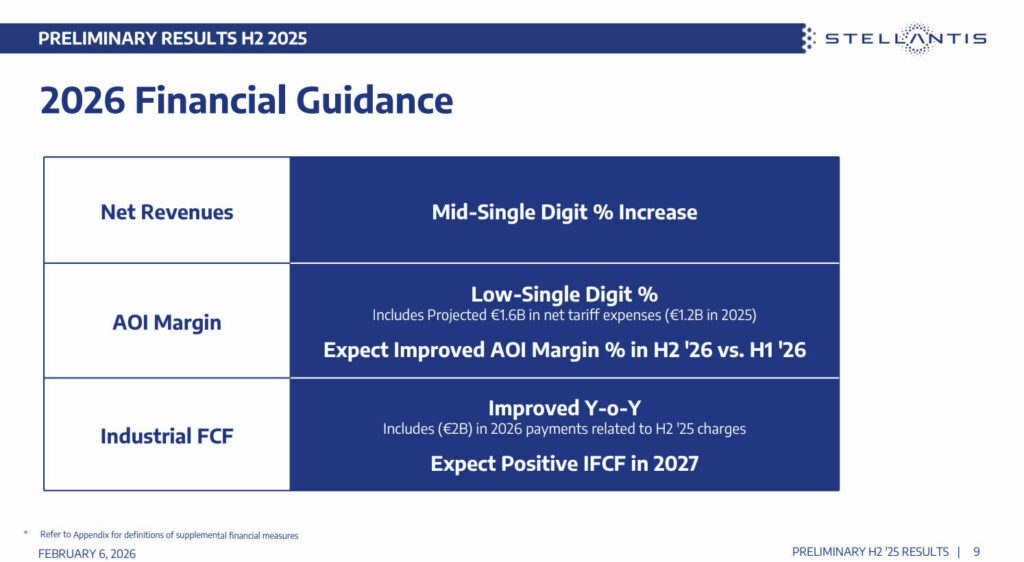

That’s a jaw dropping figure and Stellantis is responding by eliminating the annual dividend for 2026. The company’s board also authorized issuing up to $5.9 (€5) billion in bonds.

Needless to say, investors were spooked and Stellantis stock tumbled a staggering 23.69% to close at $7.28 (€6.16) per share.

A Few Silver Linings

Despite a lot of bad news, Stellantis revealed some positive developments including that second half consolidated shipments rose 11% to 2.8 million units. The company went on to note they saw growth in a number of key markets including North America, South America, Enlarged Europe, China, and the Middle East & Africa region.

The company is also addressing quality problems and this seems to be working. Stellantis said the “number of issues reported for vehicles in their first month of service decreased over 50% in North America, and over 30% in Enlarged Europe since the beginning of 2025.” The company chalked part of this early success up to improved methods and beefing up their engineering teams.

Furthermore, Stellantis is hoping a slew of new and updated products will drive sales. Key among them is the new Jeep Cherokee, Compass, and Recon as well as the facelifted Grand Cherokee and Grand Wagoneer. The Dodge Charger should also get a boost from a new twin-turbo inline-six, while the Hemi-powered Ram 1500 is already proving popular.