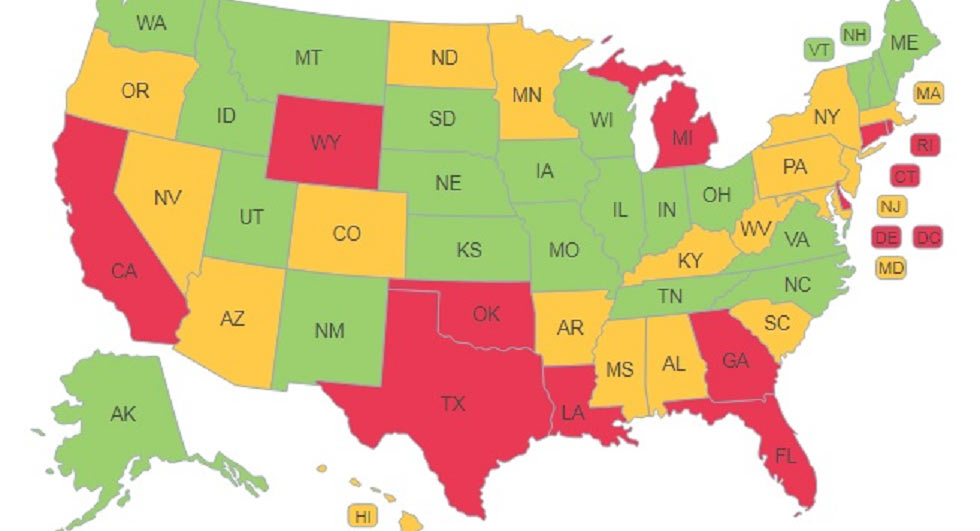

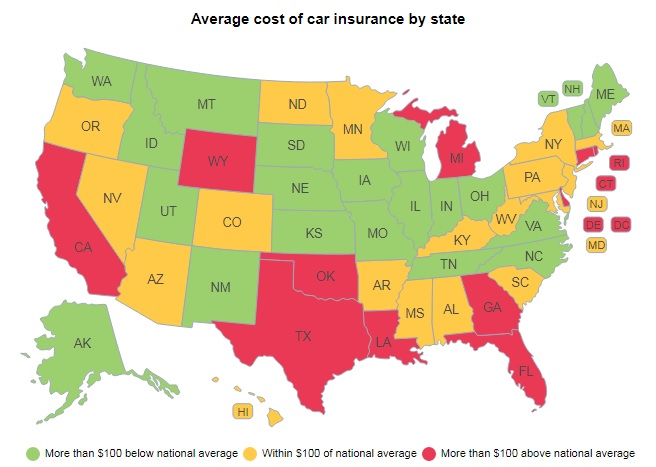

Insure.com has released its annual automotive insurance study which reveals Michigan has won the dubious honor of being the most expensive state for car insurance for the fourth year in a row.

According to the results of the study, Michiganders typically pay a premium of $2,394 which is $1,076 more than the national average. Michigan drivers also pay $474 more for insurance than second-place Louisiana and Insure.com consumer analyst Penny Gusner chalks it up to the state’s no-fault insurance.

As Gusner explains “Michigan residents can blame their unique no-fault system for their high cost of auto insurance. It allows for unlimited medical benefits for injuries sustained in auto accidents and a lot of fraud arises – the result is exorbitant car insurance premiums for car owners.”

Rounding out the top five states with the most expensive car insurance are Connecticut ($1,897), Rhode Island ($1,848), and Florida ($1,840).

At the other end of the spectrum, Maine is a downright bargain as premiums average just $864. Other places with affordable insurance include Ohio ($919), Idaho ($942), Vermont ($948), and North Carolina ($1,010).

Rates vary because of a variety of different factors including “state legal systems, how the state is affected by natural disasters, crime rates, and the frequency and severity of claims.” Of course, your age and driving history also play a big factor in determining what you’ll have to pay.

To check to see where your state ranks, you can browse Insure’s interactive map here.