It doesn’t take an expert automotive market analyst to realize that the COVID-19 outbreak and the ensuing lockdowns across the globe would leave deep scars on new car sales.

However, we do need analysts to give us the lowdown on sales numbers and, as you would expect, they’re catastrophic. According to JATO Dynamics, global vehicle sales reached 5.55 million units in March 2020, down 39 percent from March 2019.

A 39 percent drop is unprecedented and represents the largest year-on-year monthly decrease since 1980, when JATO Dynamics started to collect data. The fall in new car sales surpasses even the global financial crisis in November 2008, which brought about a 25 percent decline in sales.

Read Also: Car Sales In Germany Down 61% In April Despite Dealerships Reopening

In the first quarter of 2020, new car sales fell by 26 percent to 17.42 million units compared to Q1 2019. The huge decrease in sales in March 2020 was caused by multiple factors, including the spread of the pandemic across the globe, strict lockdowns in key markets, as well as consumer panic and economic uncertainty, which was already in the air before COVID-19.

“This downward trend is not simply due to the restrictions of free movement. The industry is being impacted largely by the uncertainty for the future, and this issue started to arise even before the pandemic took hold” said Felipe Munoz, JATO’s global analyst. According to him, the trade wars, lower economic growth and tougher emissions regulations are also to blame.

European Union sales down 52 percent year-on-year in March

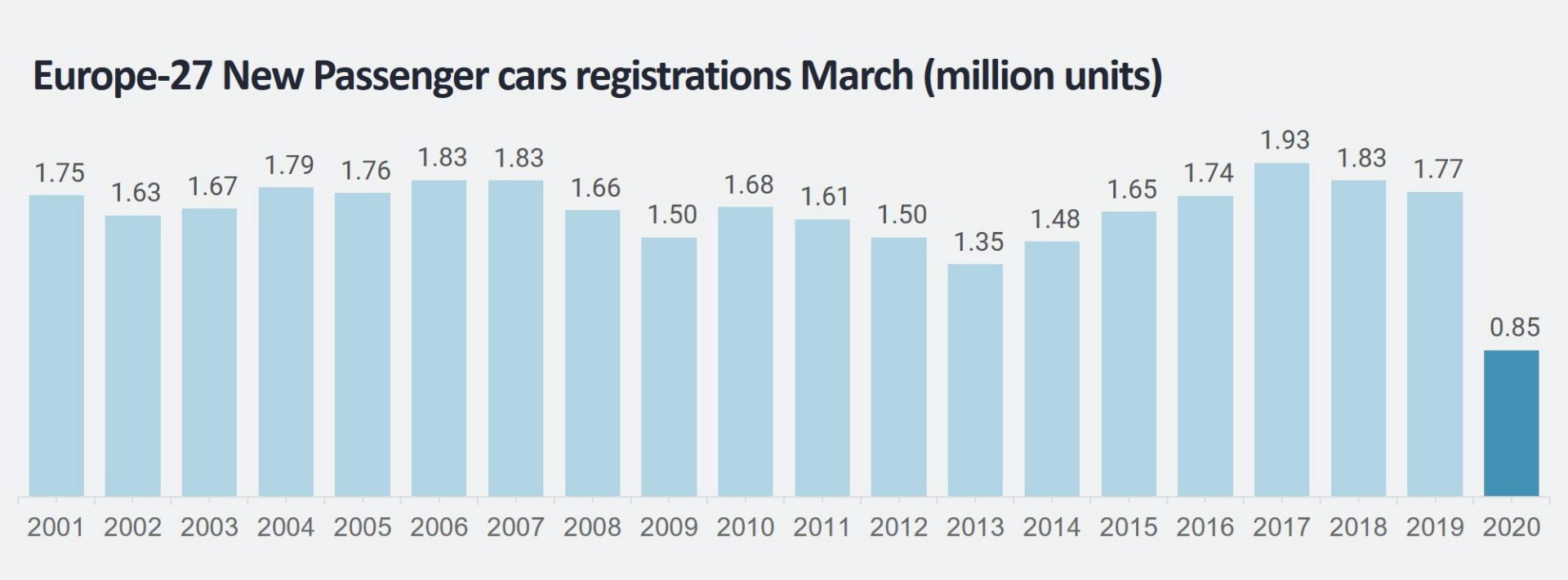

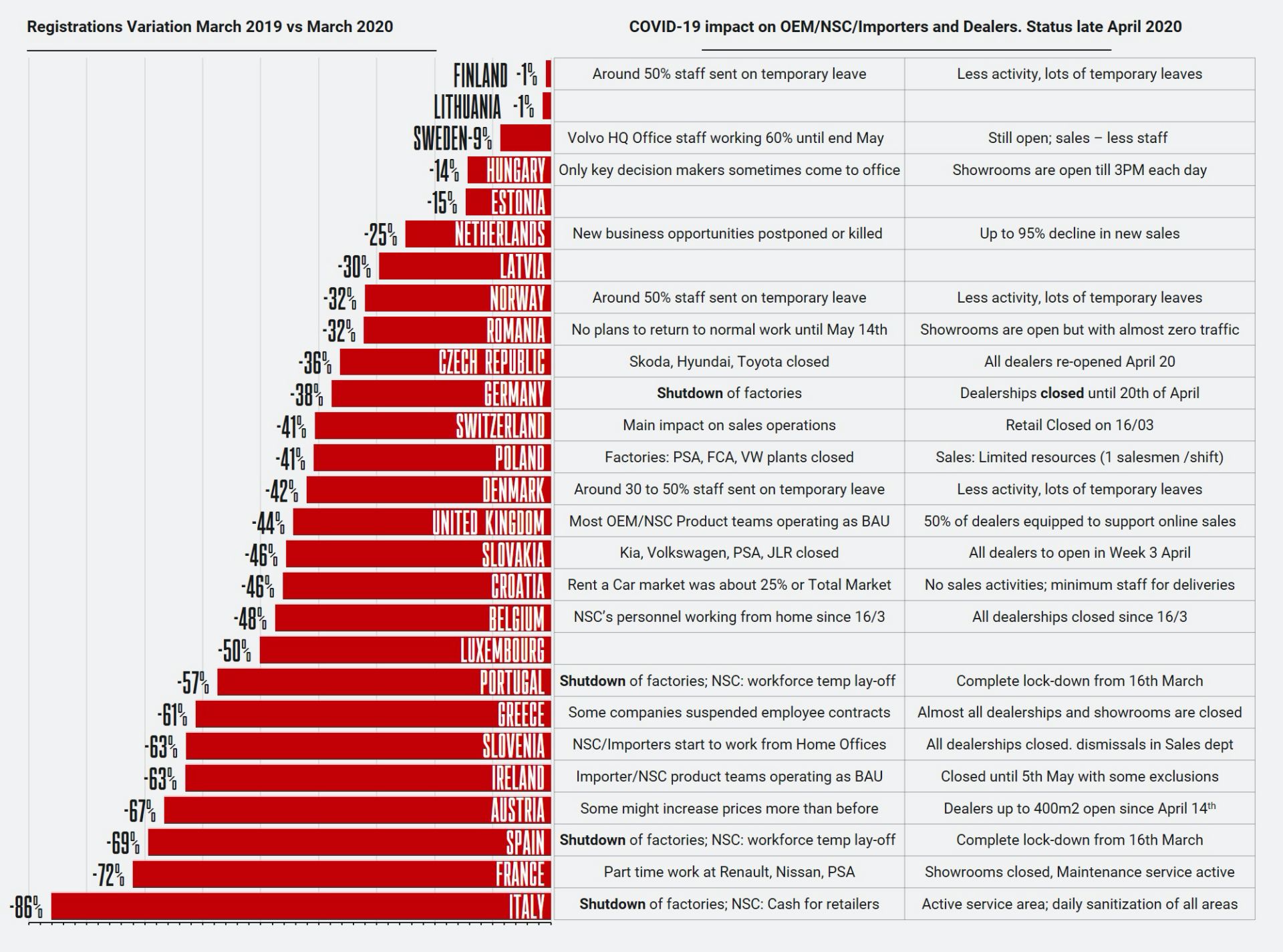

As you can imagine, not all regions of the world were affected equally, and there are big differences between countries as well. Europe was hit hardest, with passenger car registrations for the European Union (excluding the UK) in March 2020 reaching 848,800 units, down 52 percent year-on-year. This marked the lowest March sales in 38 years across the region. For the quarter, registrations amounted to 3.04 million units.

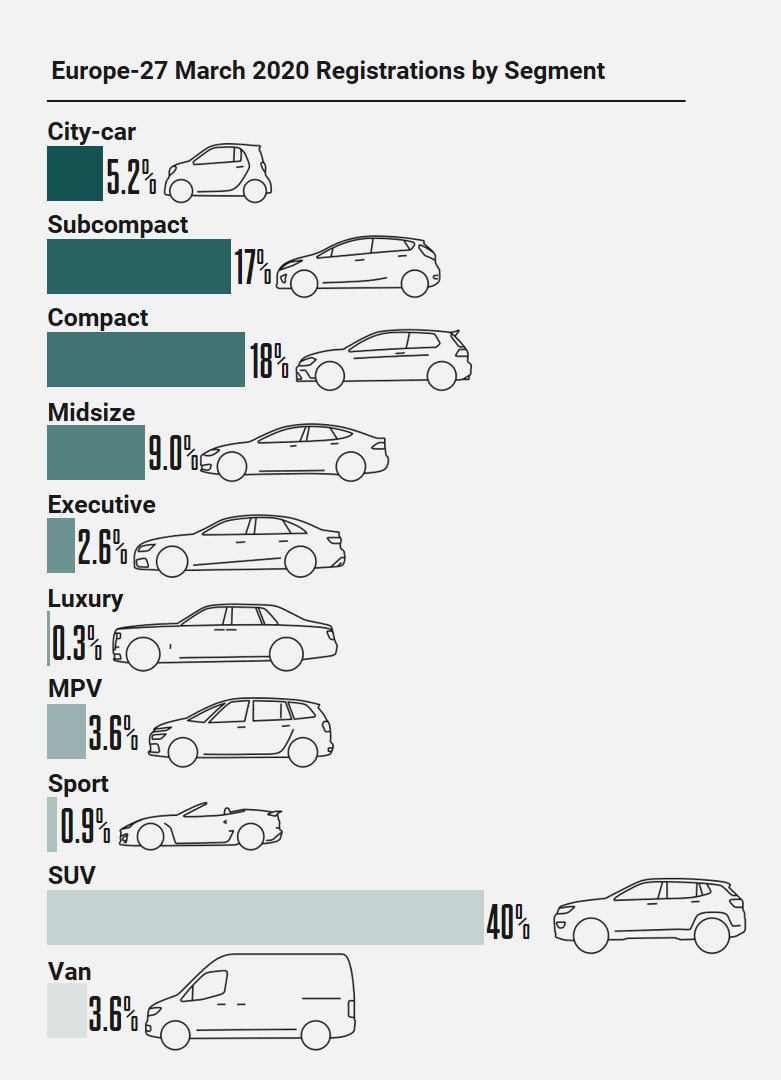

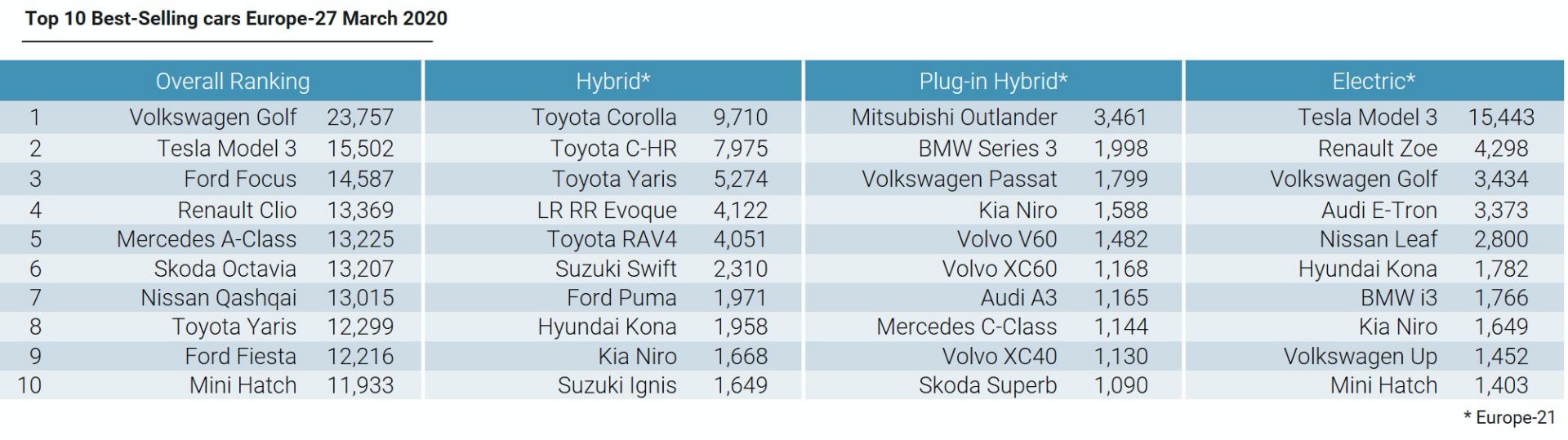

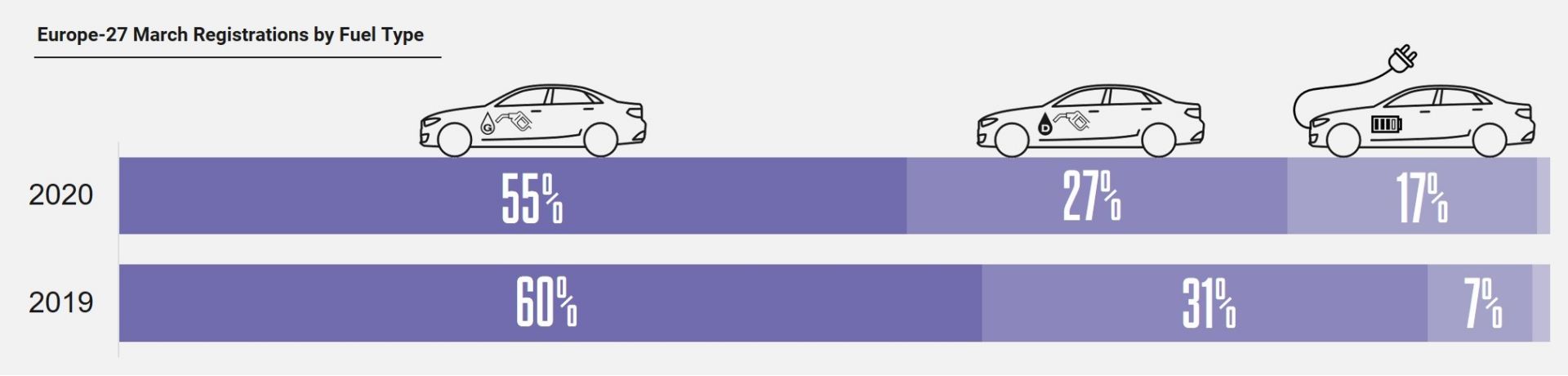

The most impacted segments were city cars, MPVs and subcompacts, while EVs posted a new record market share of 17.4 percent after a 15 percent increase in registrations to 147,500 units in March. Believe it or not, the Tesla Model 3 was Europe’s second best-selling car in March.

China and the United States also posted double-digit declines in March. With a total of 1 million units, the USA lost 38 percent of sales in March 2020 over March 2019. Mind you, the situation in China has improved since February, when sales shrank by 79 percent year-on-year. In March, the decline has narrowed to just 30 percent from a year earlier.

Elsewhere around the world, Japan, Korea and the CIS countries recorded very low decreases, while demand in Latin America fell by 30 percent to 318,000 units. India has been among the hardest hit by the disruption, with COVID-19 and the new BS-VI regulation set to come into force from April 1st 2020 creating the perfect storm. Not a single new car was sold to local buyers last month in India, the world’s fifth largest car market.

Check out the charts for detailed information on European sales performance across different vehicle segments, fuel types, and countries.