Gas prices have spiked around the world over the last year and we’re all feeling the pain at the pumps. Back in March 2021 a gallon of regular gas in the U.S. cost $2.86, but 12 months it will set you back $4.23 on average.

Some of the blame for that lies with the increase in the price of crude oil over the same period. This time last year crude was trading at just under $64 per barrel, but today its price is closing in on $95. There is, however, another party besides the oil producers that’s making a ton of money at your expense: your government.

Some countries tax fuel so heavily that almost half of the price you pay at the pump actually goes towards paying for the fuel itself. And in the UK, fuel is taxed twice, attracting fuel duty, and then having 20 percent VAT (value added tax, a kind of sales tax) stuck on top of the combined price of the fuel and fuel duty, meaning the government actually makes more money from Brits when the price of crude goes up.

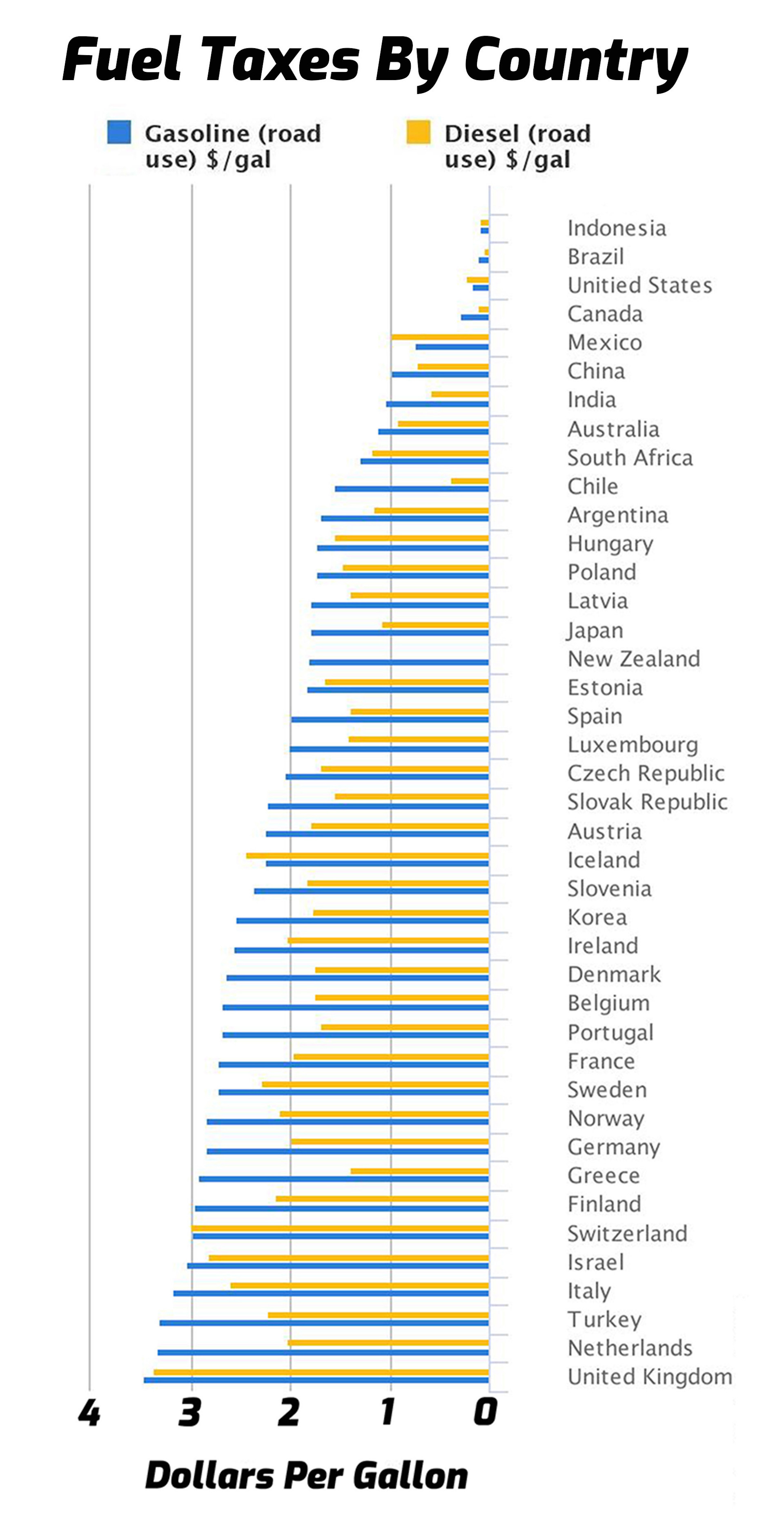

But other countries hardly levy any taxes at all. Do you know which country’s drivers have it easy, and which are getting a raw deal? The chart below from the U.S. Department of Energy’s Alternative Fuels Data Center is a couple of years old, but while the price of gas and diesel paid by drivers has changed since, it’s unlikely that the amount of tax applied by each country has altered drastically, or at least not sufficiently to prevent us getting a useful idea of the wildly different fuel taxation strategies employed around the world.

Related: Criminals Are Drilling Fuel Tanks To Steal Gas, Here’s How You Can Protect Yourself

The DoE’s table is full of interesting info, the most obvious of which is the huge gulf in taxes applied between the most driver friendly nations (Indonesia, Brazil, U.S., and Canada) and almost every other country on the planet. While UK drivers hand their government $3.49 every time they drop a (U.S., not Imperial) gallon of go-juice into their tanks, their Indonesian counterparts are charged just $0.06 as tax, and American drivers get away with paying $0.10. (The original chart is interactive, btw, I don’t have some kind of superpower for gauging measurements that helped me extract these numbers, in case you were wondering. I’ve added it below, though it might hard to see and use on mobile devices.)

That UK figure may need to be revised to account for a recent 5p ($0.04) drop in fuel duty applied by the Chancellor as a sop to Brits freaking out about huge increases in the costs of road fuel and domestic gas and oil. Though given they’re still being stiffed for $8 for every gallon at the pump, that’s like removing one floating Evian bottle from the Pacific and expecting everyone to applaud you for cleaning up the world’s oceans.

Another interesting thing to note from the graph is how differently some countries treat gasoline and diesel. While the UK, Switzerland and Indonesia apply almost the same tax to one fuel as they do to the other, most countries tax diesel at a much lower rate. In Greece, for instance, gasoline is taxed at $2.93 per gallon, but diesel only attracts a $1.40 levy. And in Chile, the government applies only a $0.39 levy on diesel, but a $1.57 charge on gasoline.

QOTD: How High Would Gas Prices Have To Get Before You’d Consider Something More Economical?

The odd men out in this case are Iceland, Mexico and the U.S., where diesel is hit with higher taxes than gasoline. One set of stats missing from the list is Russia, whose name did appear on the unedited chart, but had no figures available to view. What’s the biggest takeway from all of this? If you really hate being taxed on your fuel, move to Brazil and buy a diesel car.