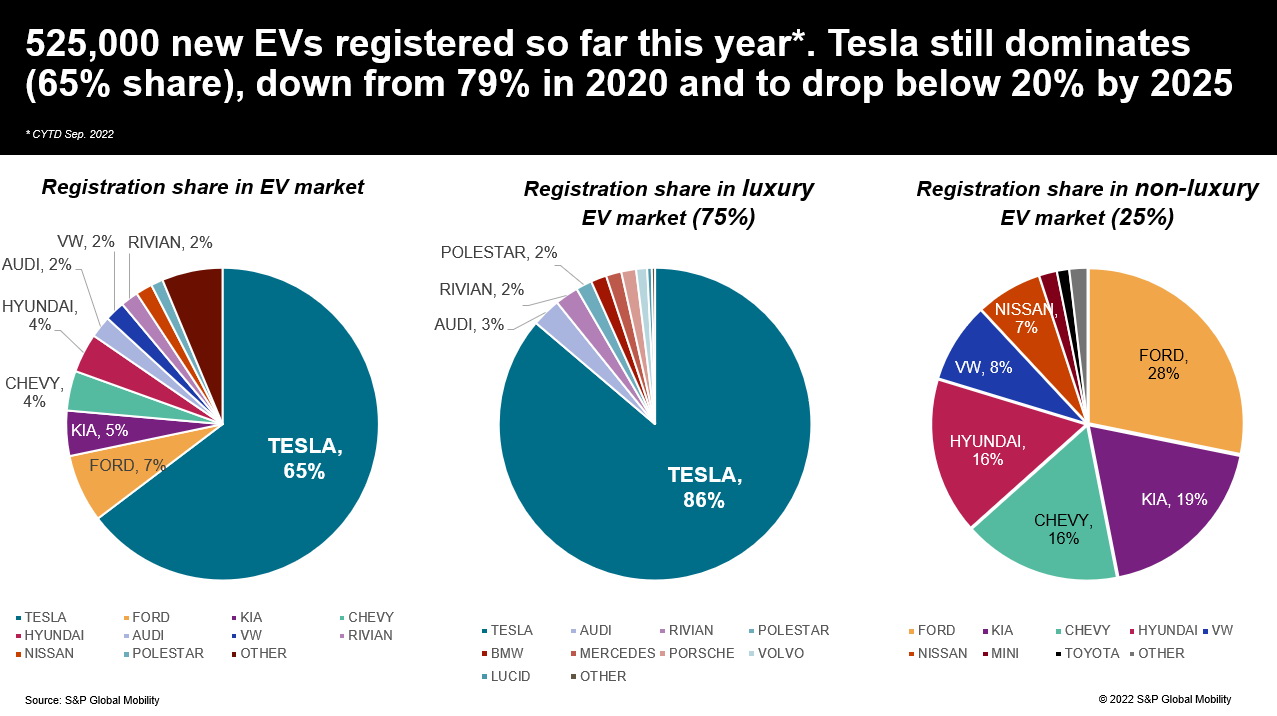

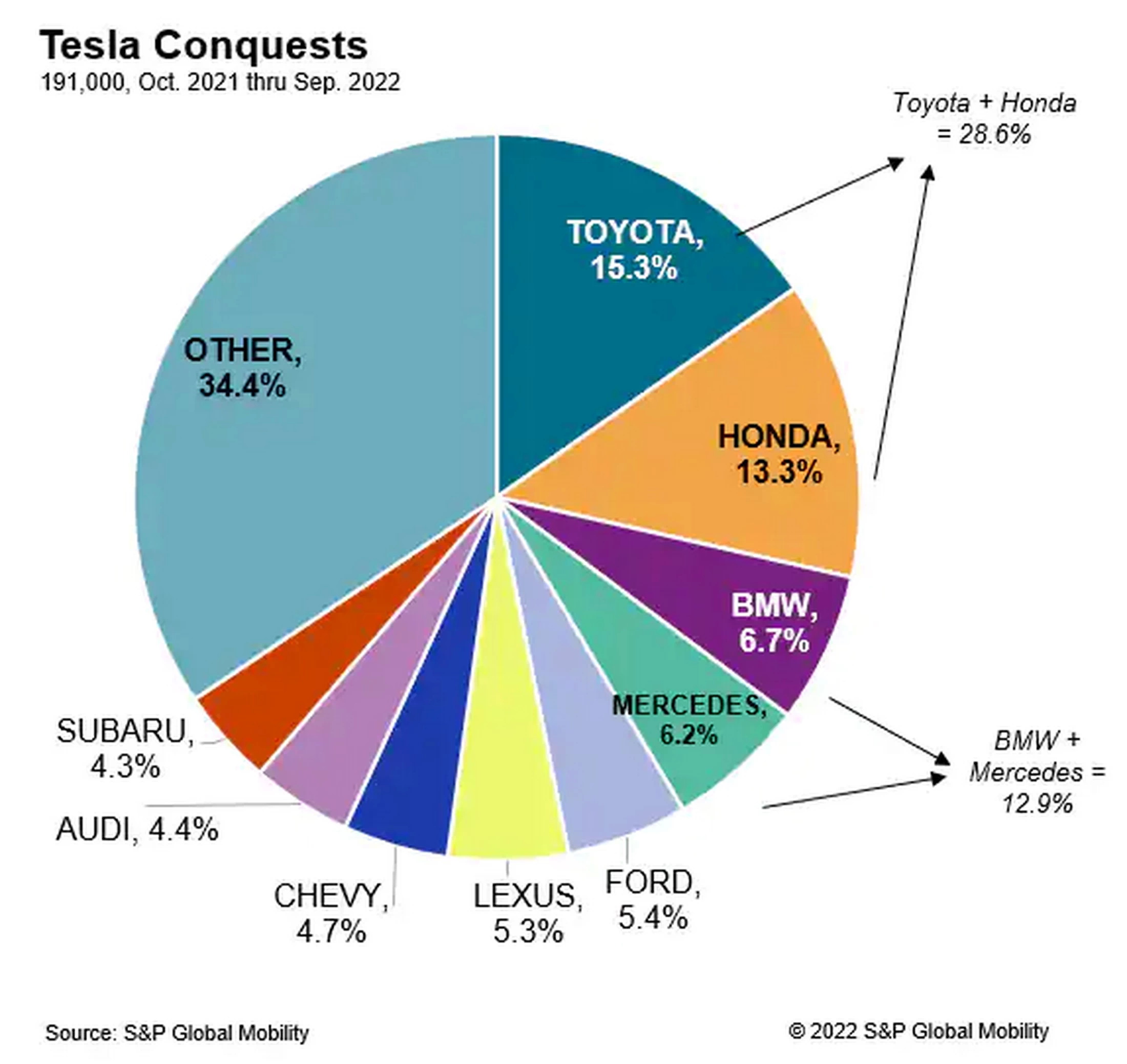

Tesla owns far more EV market share than any other car company. That dominant position is unlikely to last forever though and a new report hints at why. While luxury brands are putting pressure on the Texas-based company in the six-figure price range, non-luxury brands are wooing buyers with sub-$50k offerings that Tesla has no answer for.

Just two years ago, Tesla owned some 79 percent of the electric car market share in the United States. Today, that figure has dropped to a still dominant, but notably lower, 65 percent. According to a new study from S&P Global, it expects Tesla to own less than 20 percent by 2025 due to pressure on both sides of the market.

“Tesla’s position is changing as new, more affordable options arrive, offering equal or better technology and production build… Given that consumer choice and consumer interest in EVs are growing, Tesla’s ability to retain a dominant market share will be challenged going forward,” said S&P Global.

More: Lucid May Introduce A Tesla Model 3 Rival In The Near Future

| Total EV market share | Luxury EV market share | Nonluxury EV market share |

|---|---|---|

| Tesla: 65% | Tesla: 86% | Ford: 28% |

| Ford: 7% | Audi: 3% | Kia: 19% |

| Kia: 5% | Rivian: 2% | Chevrolet: 16% |

| Chevrolet: 4% | Polestar: 2% | Hyundai: 16% |

| Hyundai: 4% | Volkswagen: 8% | |

| Audi: 2% | Nissan: 7% | |

| Volkswagen: 2% | ||

| Rivian: 2% |

Source S&P Global

Part of the problem is that Tesla doesn’t really play in the mainstream anymore. The base Model 3 is the brand’s cheapest car and it starts at $46,900. That barrier to entry prices many buyers out and that’s to say nothing of the other models in Tesla’s lineup which are even more expensive.

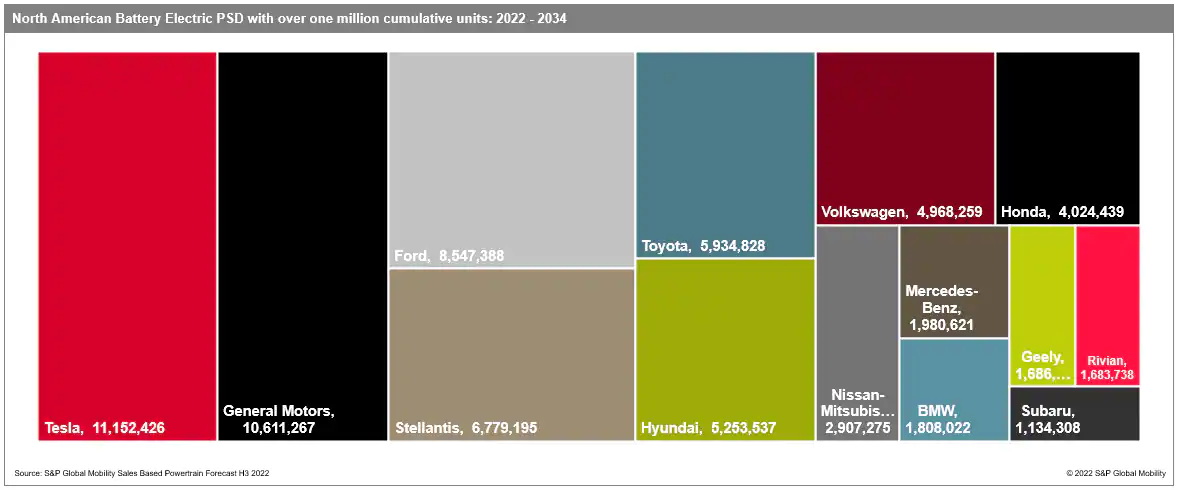

Ford, Kia, Hyundai, Chevrolet, Volkswagen, and Nissan all offer electric vehicles at lower price points. Other challengers are coming too. “S&P Global Mobility predicts the number of battery-electric nameplates will grow from 48 at present to 159 by the end of 2025, at a pace faster than Tesla will be able to add factories,” the data firm said.

Tesla does have plans to add a refreshed Model 3 late next year, with the range expected to further grow with the Cybertruck in 2023, and at some point, the Roadster and possibly a lower priced entry-level model, though timing remains unclear on this one.

More: Tesla’s Sub-Model 3 Small Car Will Cost Half As Much To Make – But Not To Buy

Of course, this doesn’t mean that Tesla isn’t going to be on top for some time. While lots of brands have predicted that they’ll overtake Tesla in the near future, all of them still have to sort out how they’ll produce enough electric cars to achieve that goal. Tesla, on the other hand, is far better equipped to take advantage of the demand for electric vehicles. It’s already built and delivered more than 3 million battery-powered cars and is only speeding up production.

“Before you feel too badly for Tesla, however, remember that the brand will continue to see unit sales grow, even as share declines,” said Stephanie Brinley, associate director, AutoIntelligence for S&P Global Mobility. “The EV market in 2022 is a Tesla market, and it will continue to be, so long as its competitors are bound by production capacity.”

“Of more than 525,000 EVs registered over the first nine months of 2022, nearly 340,000 were Teslas. The remaining volume is divided, very unevenly, among 46 other nameplates,” said S&P Global. We can imagine that if an updated Model 3 and the Cybertruck both make it to production in 2023 that Tesla will only gain followers.