The pandemic caused a spike in used vehicle prices, the reverberations of which we continue to feel today. New data shows that as monthly payments continue to rise, the value of the vehicles as collateral isn’t keeping up, leading to a risky situation for both consumers and lenders.

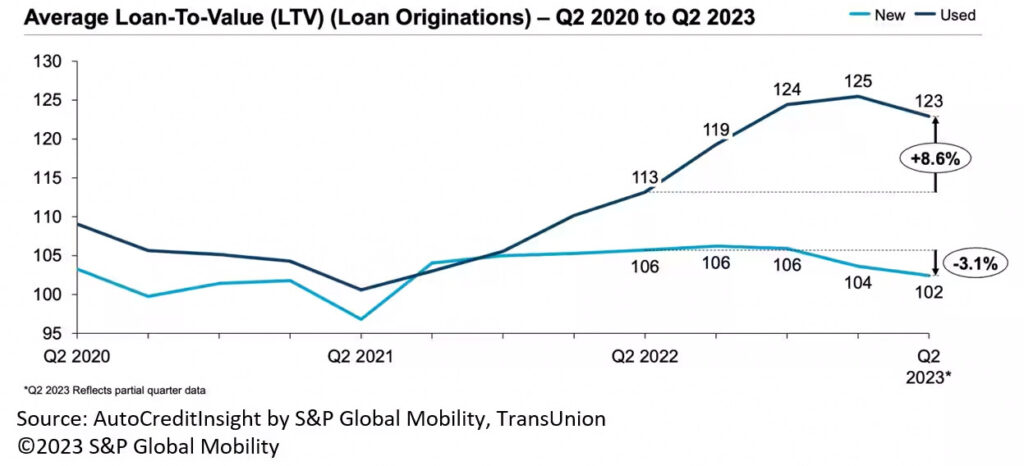

Data gathered by S&P Global shows that the loan-to-value (LTV) ratio of used vehicles is “stratospherically high” in 2023. In the second quarter of the year, the ratio was at 123% with an average payment for a used car jumping to $533.

According to S&P Global Mobility and TransUnion data:

- In Q1 2019, the LTV ratio was 110%, with an average monthly used vehicle loan payment of around $390 and an average loan term of 63.6 months.

- By Q1 2021, the average monthly payment for used vehicles rose to nearly $414. The LTV dropped to 104% due to larger down payments from COVID-19 relief money and higher trade-in values because of a used vehicle shortage. The average loan term increased to 65.1 months.

- In 1Q 2022, the full pandemic impact on car buyers became evident. Used vehicle values continued to rise, resulting in an average monthly payment increase to nearly $508. The LTV rose to 110%, and the average loan term showed a slight increase to 67.2 months.

- Through 2Q 2023, TransUnion data reveals that the average monthly payment for a used car further increased to $533, with the LTV at 123% (down from 125% in Q1 2023).

The loan-to-value ratio attempts to measure the value of a vehicle as collateral for the loan a consumer takes to buy it, and the amount of risk a lender is willing to take to hand out that money. The rising ratio suggests that although used vehicle prices are rising, the underlying value of the vehicles being bought isn’t keeping pace.

More: $23K Used To Buy A 3-Year-Old Car In 2019, Now It Can’t Even Get You A 6-Year-Old One

“Recent trends of higher originating LTV’s combined with higher vehicle prices and the possibility for quicker depreciation as vehicle values stabilize creates a pocket of elevated risk in some auto portfolios,” said Satyan Merchant, senior vice president and automotive business leader for TransUnion, which helped collect data for this study.

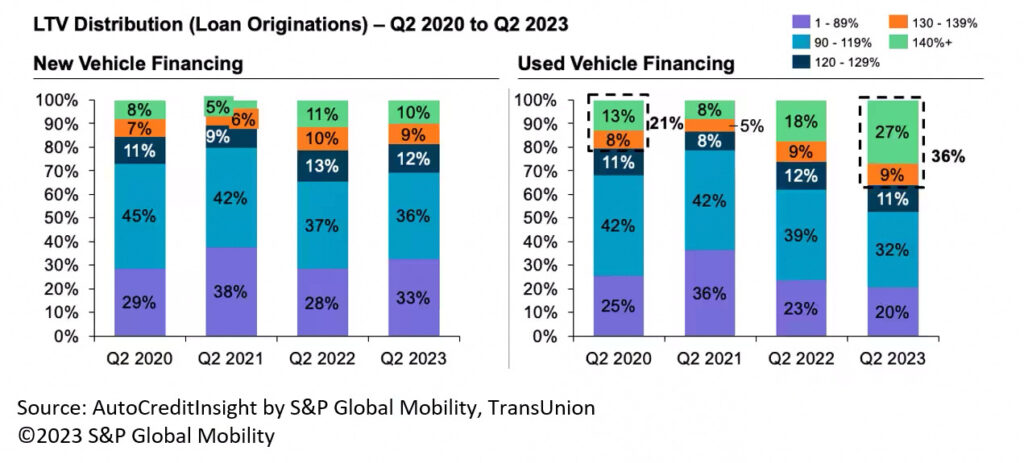

At its worst, in the first quarter of 2023, as many as 40 percent of buyers had loan-to-value ratios of 130 percent or higher. In the first quarter of 2019, just 22 percent of buyers were in this high risk group.

According to S&P Global, that means that lenders are loaning out far more money than the vehicles being bought are worth. With average monthly payments across the industry at $533 in Q1 2023, that’s bad news for consumers who normally turn to the used market for a more affordable option.

“An average monthly vehicle payment of more than $530 for used vehicles is a big chunk out of the household monthly income, and we see these challenges on monthly payments continuing for now,” said Jill Louden, associate director for AutoCreditInsight at S&P Global Mobility. “Things right now are leveling out on the new side, and used prices are slowly coming down. But compared to pre-pandemic, it’s still not a consumer-friendly market.”