- A Florida man says Toyota tracked and sold his driving data.

- He alleges insurers accessed braking and location information.

- Toyota says the driver agreed to tracking when activating tech.

A new lawsuit is shining a harsh light on how car companies and insurers handle driver data, and it’s not just about names or phone numbers. Toyota, Progressive Insurance, and a data analytics firm are now being accused of collecting detailed personal driving information without proper consent.

We’re not just talking about this person’s name, address, and other simple details. The plaintiff alleges that GPS location, driving habits, and other behavioral data were quietly gathered, then passed along to Progressive. If he’s right, it led the insurer to raise its rates, too.

More: He Had No Idea Toyota Was Selling His Driving Data To Insurers, Now He’s Suing

That driver is Philip Siefke of Eagle Lake, Florida. He says that he discovered the alleged tracking after purchasing a 2021 Toyota RAV4 and shopping for insurance, only to find Progressive already had a detailed driving profile tied to him.

That profile reportedly included a recorded “hard braking” event from the day before he sought coverage.

What Counts as Real Consent?

“The problem with the premise is the consumer is unaware it is happening,” attorney John Yanchunis of Morgan & Morgan told WTSP. Yanchunis, who is representing Siefke, added, “The automobile doesn’t know who is driving the vehicle.”

While that’s a reasonable point, it’s not the only one that Siefke is trying to make via this lawsuit. He also argues that Toyota didn’t make him meaningfully aware of what he was agreeing to.

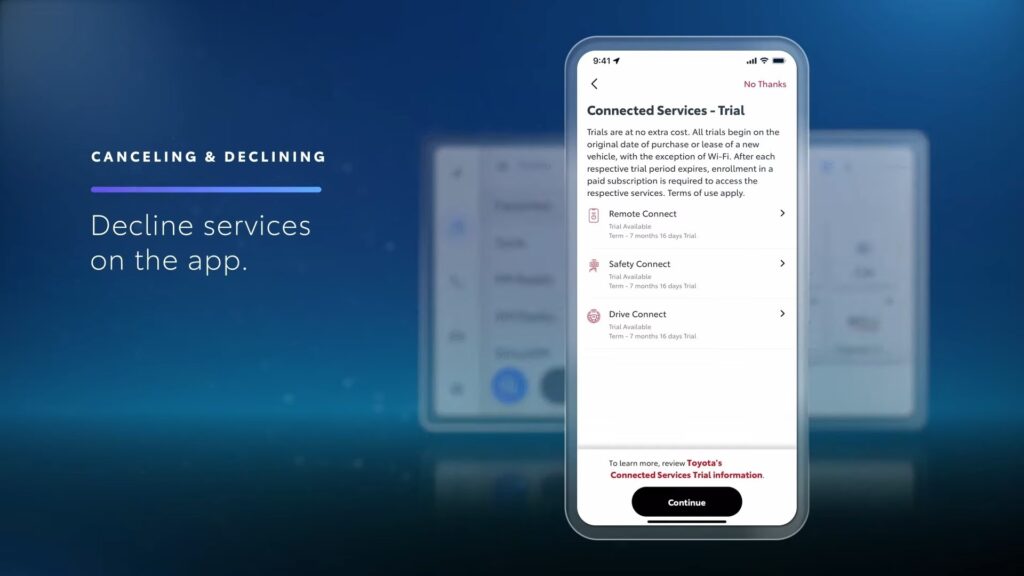

Evidently, he hit an “Accept” button in March of 2021 and again in March of 2024, confirming that he would allow Toyota to track him, record data from his car, and then share that data with others.”

Because of that, a judge has told him that he must arbitrate the case and cannot legally sue Toyota over the issue. That said, he’s continuing to try and find a legal basis for doing so.

Not Just a Toyota Problem

This isn’t the first time we’ve heard of a similar issue. General Motors and data broker LexisNexus both faced similar lawsuits when it became apparent that the two were working together and that insurance rates jumped up for some owners because of the data in question.

That pattern has since drawn direct regulatory attention. This week, the Federal Trade Commission announced a sweeping order against General Motors, banning the company and its OnStar division from selling geolocation and driving behavior data for five years.

More: FTC Bans GM From Selling Your Driving Data, But Not For Long

The ruling followed findings that GM had collected and shared data from millions of vehicles without clearly informing drivers or securing meaningful consent, using what regulators described as a misleading enrollment process tied to OnStar services and its Smart Driver feature.

Is There Any Way Out?

Telematics do have potential for positive use in the future, but it’s hard to see how they won’t just end up being a big cash grab in the end.

The only way to truly avoid that outcome is with enforceable rules around consent, transparency, and control, letting drivers see exactly what’s being collected, who it’s going to, and giving them a real way to say no. That, or skip the connected car entirely and drive something that isn’t quietly reporting back every time you hit the brakes.