- Repairable EV collision claims rose sharply in 2025.

- EVs required an average of 1.70 calibrations per estimate.

- US EV total loss values fell 6% due to depreciation.

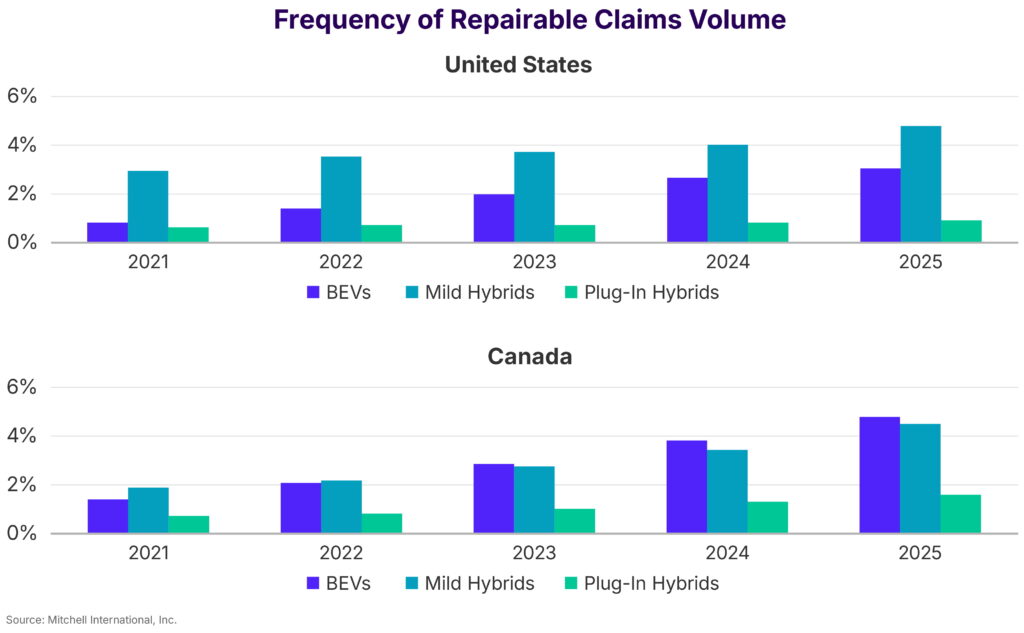

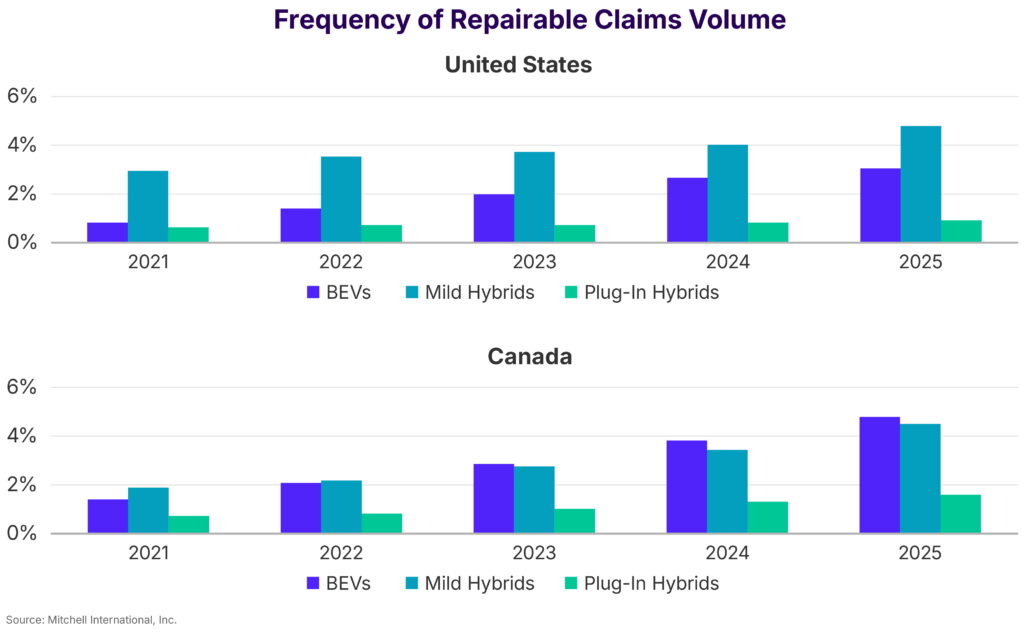

Electric vehicles are turning into a proper migraine for the insurance industry. According to the latest report from collision management software provider Mitchell, repairable collision claims for EVs jumped 14% in the US and 24% in Canada during 2025.

What makes these numbers particularly jarring is the fact that EV sales growth slowed down in 2025 as government tax incentives expired and consumer interest shifted to hybrids. Cox Automotive estimates that new EV sales dropped approximately 2% in the US, with S&P Global Mobility reporting a 0.4% decline in new EV registrations.

More: Car Repair Costs Are Exploding And It’s Not Just About Tariffs

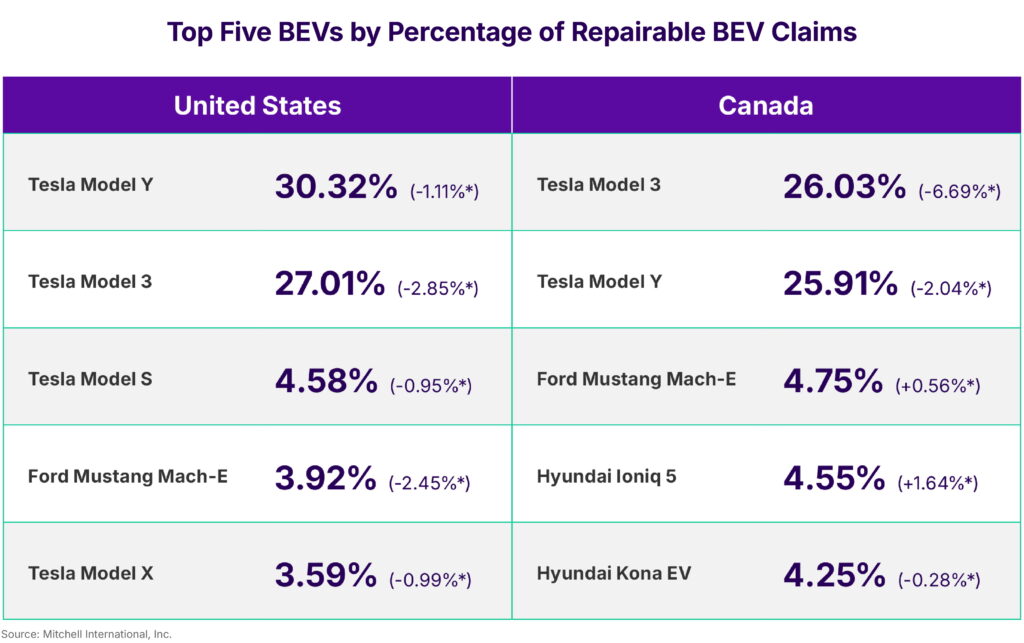

Even Tesla’s grip on the market loosened slightly, with its US market share slipping to 46.2% from 48.7% in 2024 as more competitors gained ground.

Rising Repair Complexity

Even so, the existing EV fleet is aging into more accidents, and the complexity of repairing them is becoming a logistical and financial hurdle for the repair industry.

Ryan Mandell, Mitchell’s vice president of strategy and market intelligence, explained: “Due to their dense electrical architectures, software-driven systems and interconnected, sensor-heavy designs, these vehicles require additional diagnostic and calibration operations when damaged that can add cost, complexity and cycle time to each repair.”

The “Plugged-In: EV Collision Insights” report also examined other electrified vehicles. Repairable claims for PHEVs increased 6% in the US and 26% in Canada in 2025. Mild-hybrid models (MHEV) recorded increases of 20% in the US and 29% in Canada. It is worth noting, however, that MHEV sales in the US surged 28% in 2025.

Also: Why Even The Smallest Accident Is Designed To Destroy Your Wallet

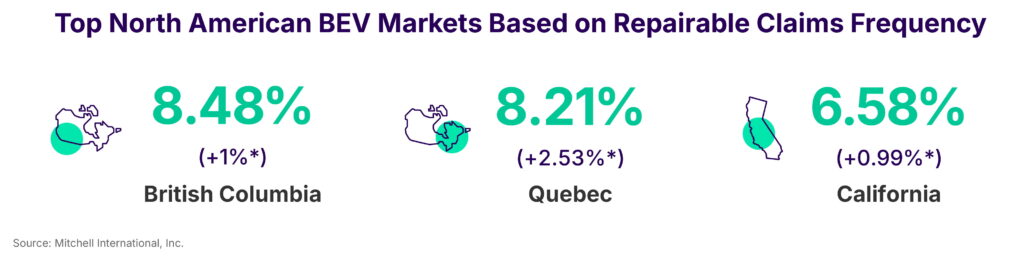

Across North America, British Columbia recorded the highest EV repair demand at 8.48%, followed by Quebec at 8.21% and California at 6.58%.

Which Models Top The Claims List?

Looking at individual models, Tesla continues to dominate claims volume. In the US, the Model Y accounts for 30.32% of repairable BEV claims, followed by the Model 3 at 27.01%, meaning the two together represent more than half of all such claims. The pattern is similar in Canada, although the positions are reversed, with the Model 3 at 26.03% slightly ahead of the Model Y at 25.91%.

The Economics Of Fixing An EV

There is at least one sliver of good news. On the repair side, the average cost to fix an EV fell 5% in the US, from US$ 6,707 to US$ 6,395, and declined 2% in Canada in 2025. ICE-powered vehicles and PHEVs remained largely flat in the US, while MHEVs saw their average claim cost rise 4%, from $4,865 to $5,054.

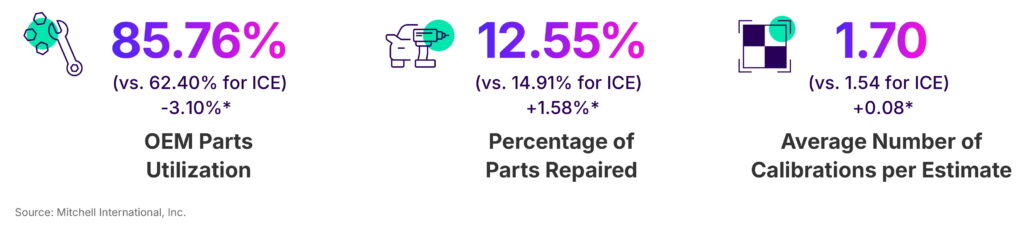

Nevertheless, the higher repair complexity of electrified vehicles is reflected in their “calibrations per estimate” rating, which tracks how often sensors and systems must be recalibrated after repairs. In 2025, the average number of revisions was 1.70 for EVs and 1.63 for hybrids, compared to 1.54 for ICE-powered vehicles.

Mitchell’s data also shows that 86% of EV parts dollars go toward OEM components, with only 13% of parts deemed repairable rather than replaceable. For ICE-powered vehicles, 62% of parts dollars go to OEMs, and 15% of components are considered repairable.

The Depreciation Trap

Mitchell also reported that total loss market values declined across most powertrain types in 2025, with EVs seeing the sharpest drops. In the US, EV values fell 6%, from US$ 30,126 in 2024 to US$ 28,185 in 2025. In Canada, they dropped 13%, from CA$ 41,775 to CA$ 36,504.

More: China’s EV Boom Is Cooling, And The Big Names Are Feeling It

By comparison, ICE vehicle values declined 2.55% in the US, from $14,241 to $13,887, and 6.12% in Canada, from $17,049 to $16,005. Hybrids presented a more mixed picture, with US values rising 4.18%, from $18,453 to $19,225, while Canadian values fell 4.40%, from $30,268 to $28,938.

Analysts attribute the steeper EV declines to accelerated depreciation, the arrival of more budget-friendly models, and shifts in consumer sentiment.