- Volvo shares fell 22.5 percent after a massive Q4 profit drop.

- Operating income plunged 68 percent to $200 million in Q4 2025.

- CEO blamed tariffs, weak demand, and lost EV incentives globally.

Volvo has spent decades crafting a capable lineup of sedans, estates, and SUVs, but it has always played second, if not third, fiddle to its German competitors, never quite breaking into the zeitgeist like BMW, Audi, or Mercedes. Financial and sales figures released by the Swedish firm show that 2025 was a particularly difficult year.

Read: Volvo’s Giving Millions Of Older Cars A New Brain Without Touching The Hardware

The company’s operating profit for the fourth quarter collapsed 68 percent to 1.8 billion Swedish Krona, or roughly $200 million. A combination of factors contributed to the drop, including US import tariffs, shrinking demand, and a weak dollar.

The fallout prompted a sharp market reaction, triggering a 22.5 percent slide in Volvo’s share price last Thursday, which CNBC reports is the company’s worst ever trading day. The stock has recovered slightly but still remains about 20 percent lower than it was.

Sales Slide Despite Growth in EVs

According to Volvo, the removal of EV incentives in the US also had a negative impact. By the end of Q4 2025, electric car sales accounted for 24 percent of Volvo’s total volume, up from 21 percent a year prior, but that clearly wasn’t enough to calm the fears of investors.

New sales data also paints a difficult picture for Volvo. In the three-month period between November 2025 and January 2026, its global sales fell 7 percent to 177,830 units. As of February, Volvo will only report figures on a rolling three-month basis, instead of a standalone month.

Of the cars sold by Volvo during the past three months, 86,462 of them were battery-electric or plug-in hybrid models, representing a decline of 2 percent from the year prior, when 88,541 were sold. The number of mild hybrids and ICE models shifted by Volvo also fell 11 percent over the period to 91,368 units.

Cost Reductions

While times are trying for Volvo, it sees light at the end of the tunnel. It is implementing an 18 billion Krona ($2 billion) cost-reduction plan and says it has successfully established a new, lower-cost base.

Speaking with CNBC, chief executive Hakan Samuelsson said the company has done “very good work…with lowering our costs and achieving a positive cash flow, so that I would highlight as the most important positive things that we have reached during the year.”

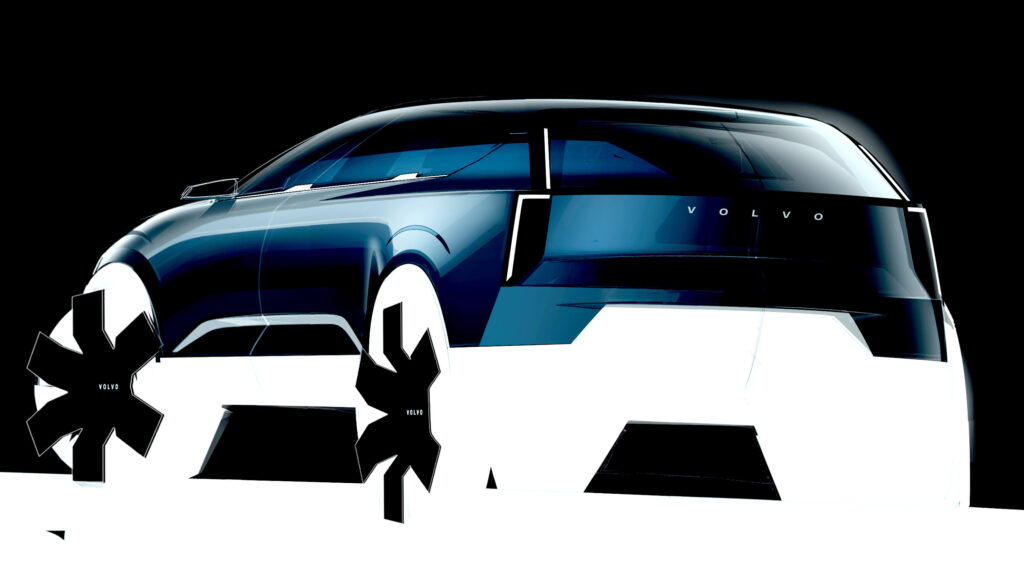

This year, Volvo expects to see its sales volume grow on a year-on-year basis, thanks in part to the arrival of the EX60 and EX70. It also predicts increases in cash generation and full-year cash flows, but warns that challenges will remain due to tariffs, regulatory uncertainty, and “softer consumer sentiment.”