China’s car industry is booming, and local brands are making bank at home, while also working hard on a plan to steal customers from Western brands in other countries. But a new study suggests simply trying to increase the number of cars it exports to regions like Europe won’t be enough to overcome a perception barrier that will limit sales growth in the West.

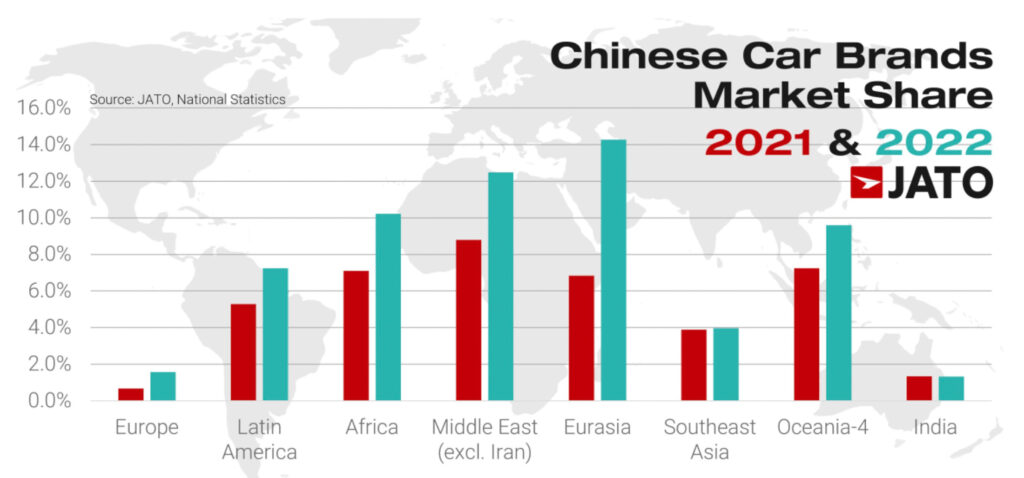

And according to Jato, it’s predominantly developed Western countries that have a beef with Chinese cars. While Chinese buyers no longer see Western imports as superior, and those in many price-sensitive developing countries seem to have no problem switching their allegiance to Chinese brands, which can be 36 percent cheaper than a Toyota, Western consumers and governments in developed countries tend to see Chinese cars in a negative light.

Ten or 15 years ago that negativity might have stemmed from the (largely correct) belief that Chinese cars were of lower quality and less advanced than the vehicles offered by familiar Western brands. But these days those gripes don’t hold up to scrutiny. Instead, much of the negative sentiment expressed today can be attributed to a desire to protect local industries and jobs, something that recently led the EU to investigate whether Chinese imports should be slapped with tariffs.

Related: China Lashes Out And Warns EU Of Consequences For Possible EV Tariffs

So what’s a Chinese automaker with dreams of global domination to do? Jato’s senior analyst, Felipe Munoz, holds up SAIC-owned MG as a shining example of how Chinese brands can break through to win Western hearts. Most obviously, while MG’s cars are designed and built in China using Chinese technology, they wear the badge of a Western brand that most Europeans will have heard of. And its mix of traditional sedans aimed at Chinese consumers and well-priced compact SUVs and hatchbacks created with international buyers in mind has also helped its sales rocket. MG shifted just 75,000 cars in 2015, but 450,000 in 2022.

Lotus and Volvo are now also owned by Chinese companies and Jato says it’s quite possible that other Western carmakers might be bought up to help China gain recognition and trust in export markets. It also says to expect tech and charging infrastructure collaborations between Chinese and Western brands in the West.

Source: Jato