- Nearly one in three US trade-ins now hopelessly underwater.

- Average negative equity smashes all-time records at over $7k.

- More than 25 % of upside-down trade-ins owe $10k or more.

If you have a sinking feeling about your car loan, you’re not alone. New data from Edmunds shows American car buyers are sliding deeper underwater than ever before, and the financial pain is getting worse by the month.

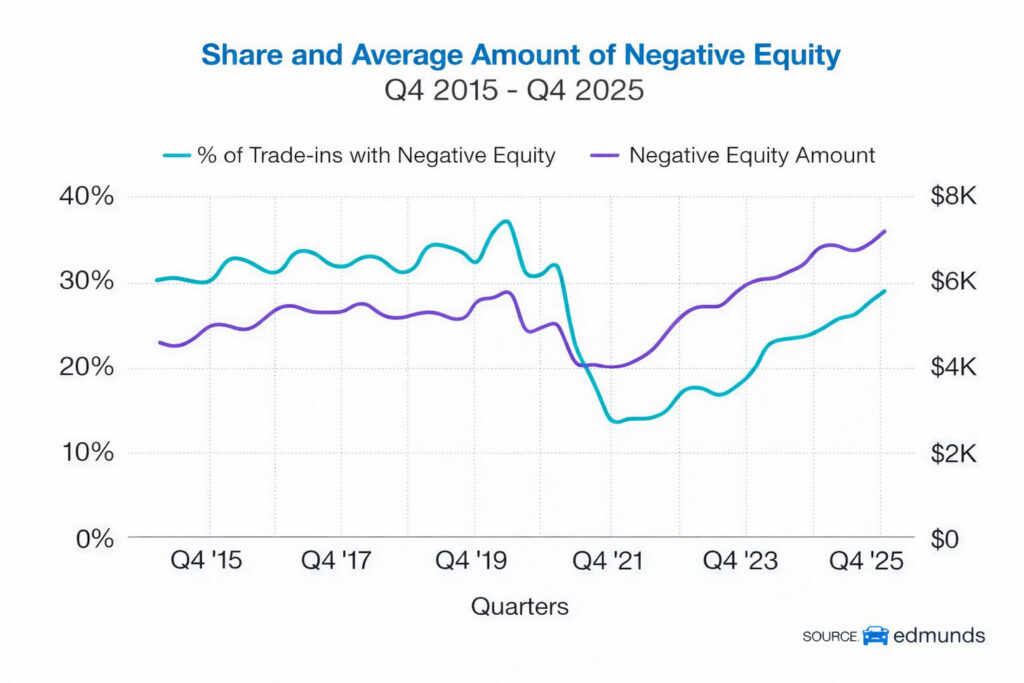

In the final quarter of 2025, a hefty 29.3 percent of people trading in a vehicle toward a new one owed more on the loan than the car was worth. That’s the highest share since the first quarter of 2021, when 31.9 percent of trade-ins were underwater, according to Edmunds.

Related: Car Payments Have Become The New Mortgage As Some Americans Face 100-Month Loans

Even worse, the average amount of negative equity hit a record $7,214. A growing chunk of buyers are not just a little upside down, they are dramatically upside down.

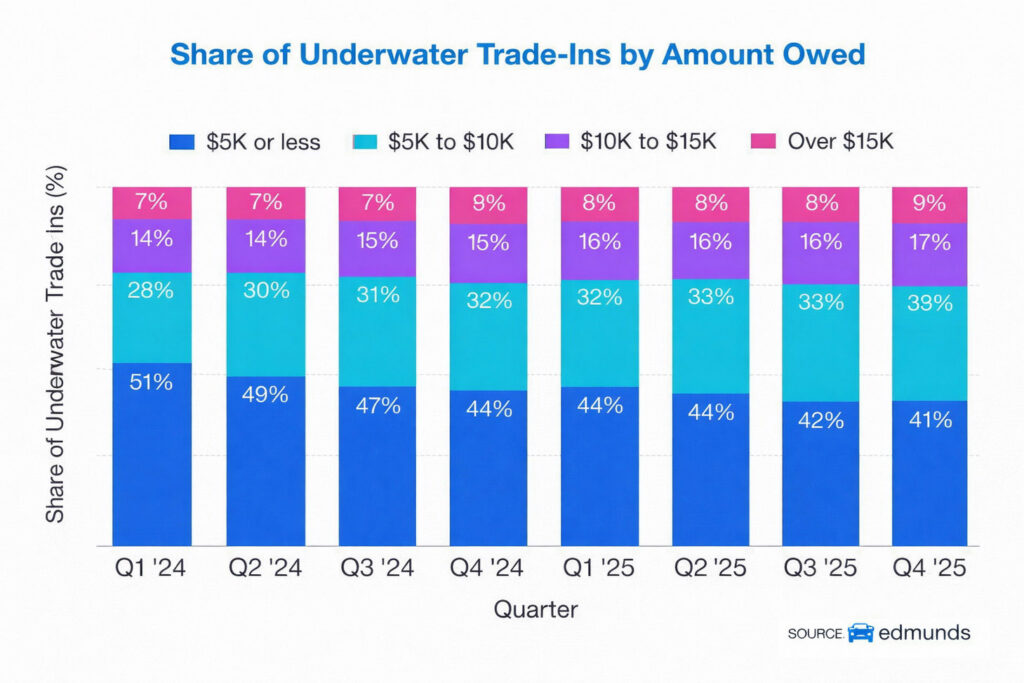

More than a quarter of underwater trade-ins carried at least $10,000 in negative equity, another all time high. Specifically, 27 percent of underwater trade-ins in Q4 2025 had five-figure negative balances, with 17.4 percent owing between $10,000 and $15,000, and 9.2 percent owing more than $15,000, both of which are record highs.

Nearly one in 10 drivers showed up at the dealership buried under more than $15,000 of debt before even picking out a new ride. That is not a financial speed bump, that is a sinkhole.

Why The Numbers Keep Rising

The problem has been brewing for years. Many of these loans were taken out during the pandemic and chip crisis when cars were scarce and prices were sky high. Buyers paid close to sticker price, sometimes more, and often stretched loan terms to make the payments work. Now those same cars are worth less while loan balances remain stubbornly large.

When drivers trade in early, they usually roll that leftover debt into the next loan. Edmunds says buyers carrying negative equity financed an average of $11,453 more than normal shoppers. Their typical monthly payment climbed to $916, far above the industry average of $772.

To make those payments feel manageable, more people are choosing 84 month loans, which only drags the problem out longer. Longer loans mean slower makes it more likely the next trade-in will be underwater, too. Edmunds says that almost 41 percent of new-vehicle purchases with negative equity are financed with 84-month loans.

The Cost of Trading In Too Soon

It becomes a financial merry go round that never stops spinning. Experts say the best escape plan is simple but not always easy. Keep the car longer if possible, pay extra toward the principal, and avoid rolling debt into another purchase.

And if you’re really hellbent on selling, try selling privately instead of trading in. That can help you bank more money to put towards paying off the loan, Bruce McClary, senior vice president at the National Foundation for Credit Counseling, told CNBC.