LiDAR developers are seeing rising support from the automotive industry as the technology becomes more affordable, with the likes of General Motors and Volkswagen moving to pad their order books.

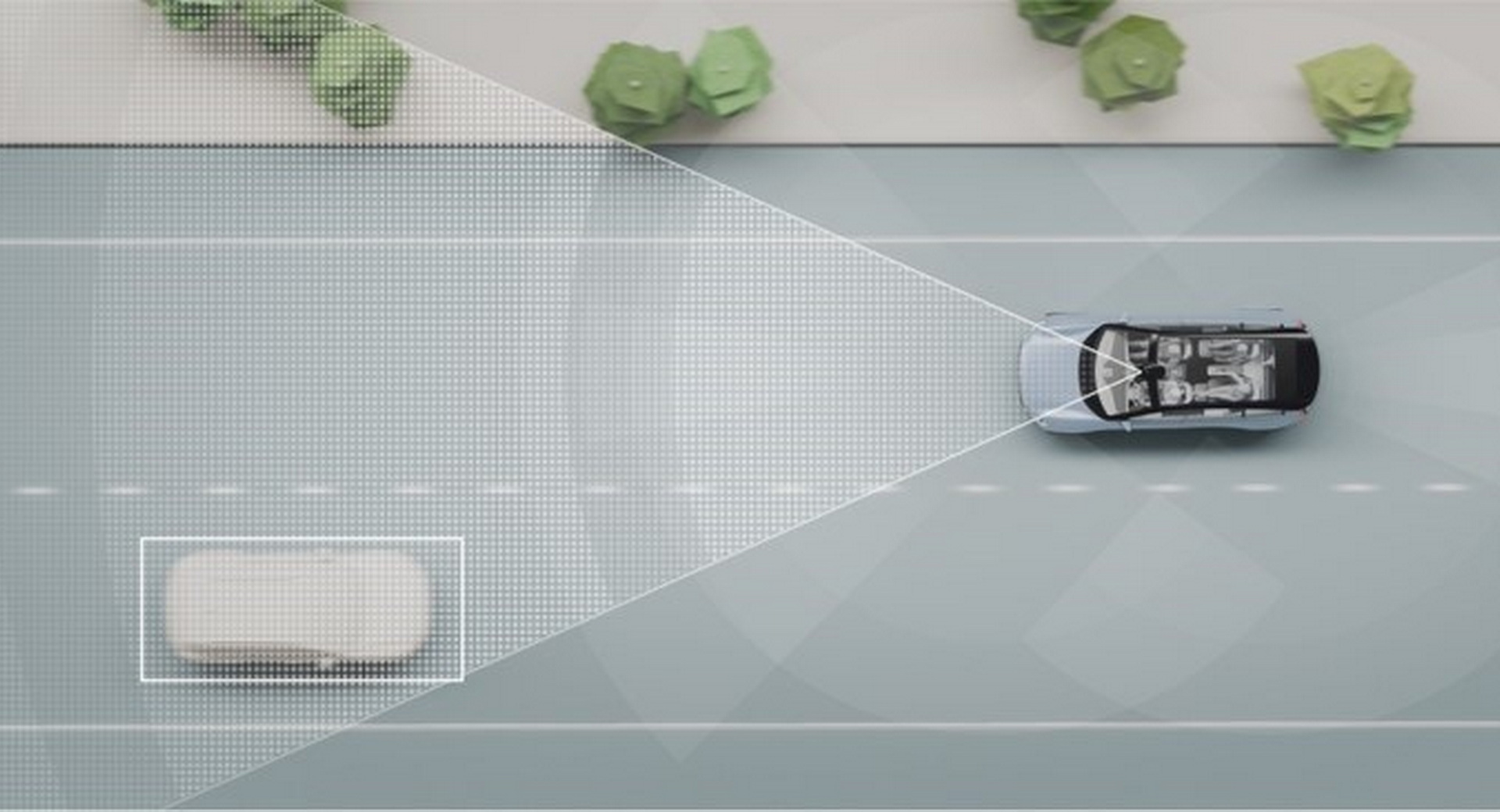

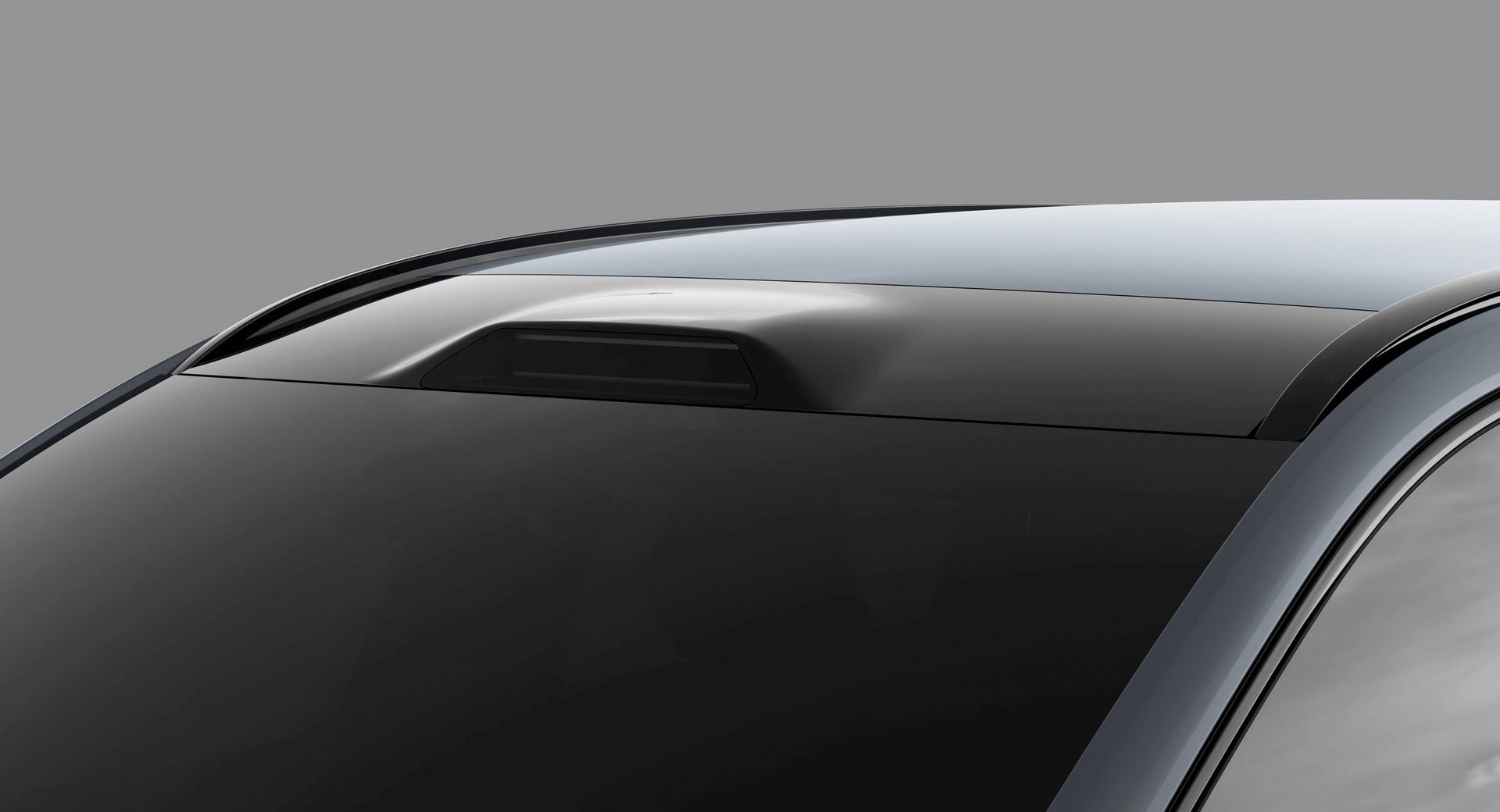

Although Tesla may still be on the fence about the tech, LiDAR is seen by many as a vital component of furthering self-driving tech. It commonly works in harmony with other camera-based systems to provide vital feedback on a car’s surroundings for safe automated driving. The industry is now shifting to new LiDAR technology with fewer moving parts. These mechanisms, known as hybrid solid-state and solid-state LiDAR, not only contribute to lowering the cost of these sensors but are also more fitting to the automotive environment. Although these versions have lower capabilities than the spinning technology, combining four to eight solid-state LiDAR sensors can match the performance of their mechanical counterparts, at a lower cost to boot.

According to Transport Topics, GM has hired Cepton, a San Jose, California-based company, as their LiDAR supplier for developing their Level 3 Ultra Cruise system. It’s the next step for GM, who’s SuperCruise ADAS (advanced driver assistance systems) has been employed since late 2017. SuperCruise is a Level 2 system, which is offered in models like the Cadillac Escalade, the GMC Hummer EV and Sierra, and the Chevrolet Silverado.

Read: A Growing Number Of Carmakers Are Using Lidar Sensors, Tesla Ain’t One Of Them

According to Transport Topics, Volkswagen is another notable automaker to employ solid-state LiDAR technology. Their driver assist technology, IQ Drive, first appeared in the 2021 Atlas and Atlas Cross Sport SUVs. Now VW’s software unit Cariad is shooting to develop advanced IQ Drive systems that enable limited hands-free driving. The firm has invested $4 billion in LiDAR sensors through Innoviz Technologies, claiming that this system will be available in future models.

Meanwhile, Chinese players are adding these sensors to their production vehicles too. Baidu, Pony.ai, and WeRide, for example, are already offering hybrid solid-state and solid-state sensors as part of their latest technology packages.

Robotaxis, such as Argo AI and Waymo, continue to plump for spinning LiDAR systems, as the use-case requires sensors to be of a high caliber. However, with BloombergNEF data suggesting that the cost of such packages can range between $35,000 and $100,000 per vehicle, it’s no wonder why mainstream makers are opting for solid-state tech.