- Although Q1 EV sales were up year-over-year, they are down as compared to the fourth quarter of 2023.

- Tesla’s size means that its difficult first quarter had a big impact on the rest of the EV segment.

- However, nine automakers saw EV sales growth of 50 percent or more.

Automakers sold 268,909 electric vehicles (EVs) in the first quarter of 2024 in the USA. While this represents a 2.6% increase compared to the same period in 2023, it marks a significant slowdown in the growth rate observed in recent years.

EV sales experienced a surge in previous quarters, with year-over-year growth of 81.2% in Q1 2022 and 46.4% in Q1 2023. However, Q1 2024 saw a much more modest increase of just 2.6%. Furthermore, this figure represents a notable decrease of 15.2 percent compared to the preceding quarter, Q4 2023.

This data suggests a potential plateauing of EV sales growth in the US market. While overall sales remain higher than last year, the significant slowdown in growth, coupled with the decline from the previous quarter, warrants further investigation.

Read: EVs Lose Share And Hybrids Gain As Europe’s Car Market Dips In March

Much of that hit can be attributed to Tesla, which delivered 13.3 percent fewer vehicles in Q1 2024 than it had a year earlier, according to data obtained by Cox Automotive. Previously, its double-digit sales growth helped drive up the entire segment’s performance.

“As anticipated, Tesla’s sales took a hit, influencing the overall market dynamics,” said Stephanie Valdez Streaty, Cox Automotive’s director of industry insights. “However, a few brands saw significant EV sales increases, achieving over 50 percent year-over-year growth.”

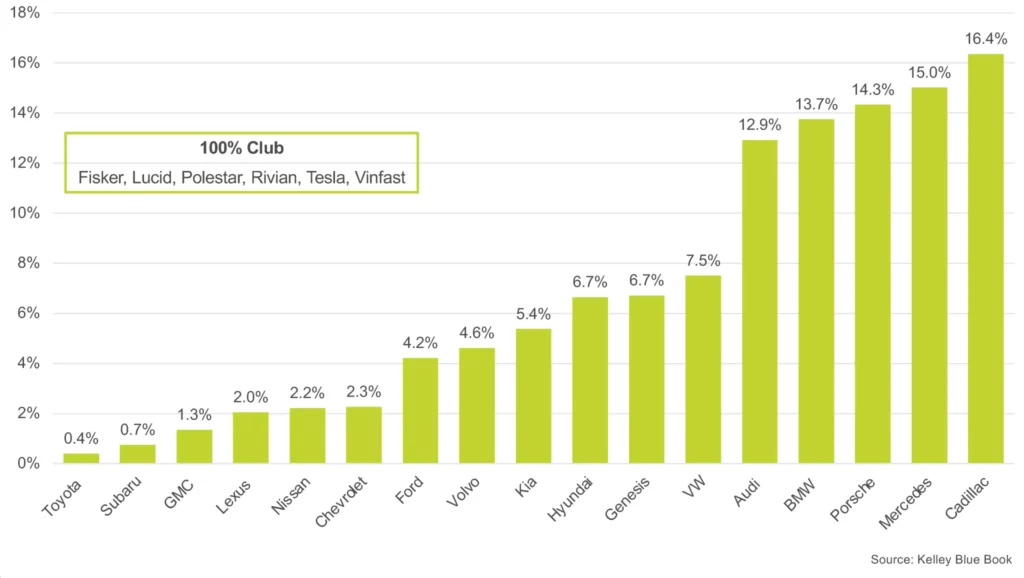

In all, nine manufacturers recorded EV sales growth of more than 50 percent in Q1, 2024: BMW, Cadillac, Ford, Hyundai, Kia, Lexus, Mercedes, Rivian, and Vinfast. As a result, Tesla’s market share fell from 61.7 percent down to 51.3 percent, year over year.

However, Tesla’s struggles remain problematic for other automakers, even those whose performance has improved. Such is the automaker’s influence that when it lowers prices, others must follow.

“Whether it’s a retailer, whether it’s a manufacturer — all of us in this EV space are going to do a whole bunch of stuff we don’t want to do, mainly as a reaction to Tesla,” Howard Drake, the dealer principal of Casa Automotive Group, told Autonews. But Tesla isn’t the only cause of discounts. An oversupply of EVs is also prompting dealers to cut prices.

For instance, Nissan is offering nearly $16,000 off the Ariya, while Mercedes is prepared to cut nearly $20,000 off the price of the EQS SUV to attract customers. On average, EVs received nearly $6,000 in discounts in Q1.

EV SALES BY BRAND

While that may make them more attractive to consumers, it puts dealers and manufacturers in a tough spot. Some dealers said that they were so desperate to get EVs off their lots that they were selling them at a loss. That’s on top of the nearly $6,000 automakers are estimated to be losing on every EV they sell for less than $50,000. Unfortunately for them, things aren’t expected to get simpler any time soon.

“We are calling 2024, ‘the Year of More’. More new products, more incentives, more inventory, more leasing and more infrastructure will drive EV sales higher this year,” said Valdez Streaty. “Even so, we’ll continue to see ups and downs as the industry moves towards electrification.”

The Best Selling EVs

As for the best-selling EVs in the first quarter of 2024, Tesla continues its dominance. The Model Y maintained its position as the top-selling electric model in the USA, with sales totaling 96,729 units. While this represents a modest increase of 1.4% compared to the same period in 2023, its hold on the market remains strong, commanding a segment share of 35.40%. Following closely behind is the Tesla Model 3, though it experienced a significant decline of 43.9% in sales compared to Q1 2023.

On the other hand, the Ford Mustang Mach-E saw a huge surge in popularity, with sales skyrocketing by 77.3% year-over-year. However, much of this success was likely due to massive discounts introduced in February to clear leftover 2023 models. The Rivian R1S also made significant strides, with sales increasing by a staggering 588.7% compared to the previous year.

You can see the complete list in the table below.

Additional reporting by John Halas