- Toyota will double down on hybrids and ICE in key regions.

- China will remain Toyota’s electric-first market going forward.

- GR GT V8 hybrid proves Toyota’s engine push isn’t just talk.

Saying the automotive world is in a bit of limbo may be an understatement. On one hand, you have the world’s largest market, China, accepting EVs and plug-in hybrids in even greater numbers than ever before. Meanwhile, in Europe, manufacturers are pulling back on their EV manifestos as the European Union provides some respite in the face of slower-than-predicted adoption.

Toyota, by contrast, has always been pro-ICE. For years, the company has questioned its competitors and governments, who have been advocating exclusively for electric vehicles. And while the company has shown off various plans for EVs, they’ve maintained a more balanced approach.

Read: Toyota GR GT Looks Like A Batmobile And Hits Like A Supercar

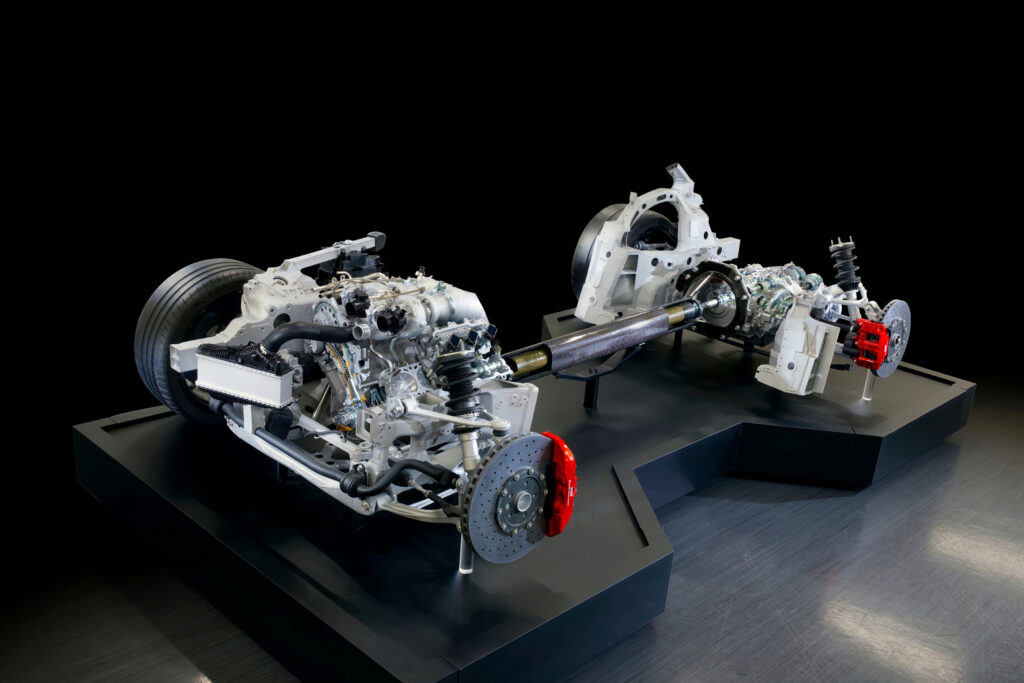

Now, it may be clear that Toyota wasn’t going to say goodbye to combustion without a fight, but we imagine not many would have predicted the unveiling of the GR GT: a production-slated halo supercar with a ferocious twin-turbocharged 4.0-liter hybridized V8 engine.

The Fight for Identity

In an era of tightening emissions regulations and downsized powertrains, the decision to green-light a V8 may seem almost rebellious. But for Toyota, the GR GT isn’t about volume or compliance alone. It’s about identity.

Nikkei Asia notes that the GR GT has been built without the assistance of Yamaha, unlike its spiritual forefathers, the 2000GT and Lexus LFA. “Automobiles, as an industrial product, are in danger of becoming commoditized,” says Toyota Chairman Akio Toyoda. “The engine still has a role to play,” underscoring the importance of the in-house powerplant.

The reality is that Toyota’s focus on keeping engines around will permeate throughout its lineup for the foreseeable future. In June 2025, Toyota convened suppliers at an internal combustion engine rally, where executives outlined plans to develop new engines, including high-output units, while maintaining overall engine production volumes through 2030.

It was a clear signal that Toyota sees a long runway for combustion, even as the market fragments.

Satisfying the Giants: US vs China

However, Toyota is still hedging its bets with EVs, especially when it comes to China. Over there, the car-buying population continues to march towards an all-electric future.

Toyota, like all foreign manufacturers, is feeling the pinch against local rivals. At a supplier event in Shanghai last summer, a Toyota executive drew rare applause by declaring, “In China, we will focus not on cars for the global market, but on cars made specifically for China.”

More: Toyota’s New Flagship bZ7 Sedan Is Here But Not For Us

He added pointedly that if Japan’s headquarters hesitated on investment, he would “explain things to them directly.”

That shift is already visible in the product lineup. The bZ3X electric SUV, launched in March 2025 through GAC Toyota, was co-developed with Guangzhou Automobile Group and uses cost-effective lithium iron phosphate batteries. Priced from 109,800 yuan or about $15,300, it surpassed 10,000 units in monthly sales by November. A bZ7 electric sedan is set to follow.

Hybrid Momentum in America

Back in the US, where EV adoption is not as clear-cut, Toyota is investing in hybrid production. The move is driven by strong demand as hybrids accounted for roughly 13 percent of new-vehicle sales in the U.S. during the third quarter of 2025.

Toyota opened its new battery plant in North Carolina on November 12. Toyota Motor North America President Tetsuo Ogawa called it “a pivotal moment in our company’s history.”

On the same day, Toyota announced plans to invest up to $10 billion over five years to expand U.S. production of hybrids and related components, boosting output at five American plants and reducing reliance on Japanese imports.

Is Betting on Everything the Smartest Bet?

Of course, building cars powered by everything from V8 hybrids to LFP-battery EVs is expensive. Toyota spent ¥1.3 trillion on R&D in the year ending March 2025, which is roughly on par with BYD, and well ahead of many rivals.

To manage the burden, Toyota has begun leaning more openly into partnerships, including work with NTT on AI-based crash prevention and a collaboration with Waymo on autonomous driving.

In a market increasingly obsessed with picking a single technological winner, Toyota’s refusal to do so may look risky. But if the global auto future really is plural rather than uniform, betting on engines, rather than shunning them, may yet prove to be the company’s most calculated move of all.