These are not the best times for the Renault Group and the company’s third quarter results reflect that, as sales were down 4.4 percent to 852,198 units, with revenue falling by 1.6 percent to €11.29 billion ($12.54 billion).

The company said the disappointing results were also due to a drop in production at partners Nissan and Daimler, declining demand for diesel engines, and a slowing global market. Renault uses its plants to build vehicles for Nissan and Daimler, as well as manufacturing diesel engines for other automakers.

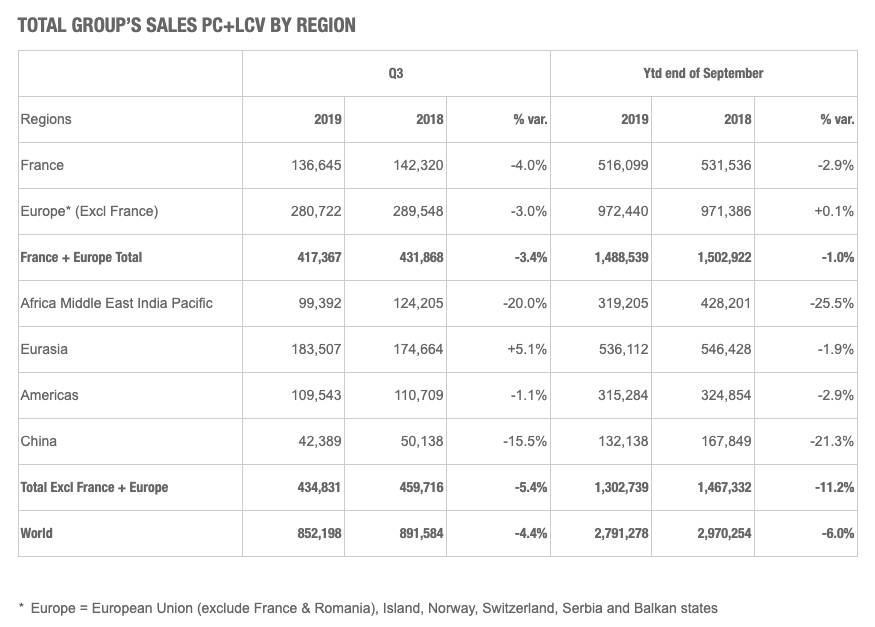

In Europe, which accounts for half of Renault Group’s worldwide sales, deliveries dropped 3.4 percent even though the market was up by 2.4 percent. The company blamed a strong year-ago comparison and the change of generations for the Clio supermini, as some versions of the 2020 model have experienced delays. In China, the group’s sales plunged 15.5 percent in a market that was down 5 percent.

Also Read: French Government Is OK With A Non-French Renault CEO

Overall, the Renault brand was most affected by the decline, with sales down 10 percent. In contrast, the low-cost Dacia marque saw deliveries jump by 9.3 percent.

Given the third-quarter results, Renault revised its forecast for the growth of the global auto market downwards, expecting a year-on-year decline in 2019 of around 4 percent, compared to around 3 percent previously. The carmaker also expects its operating margin to drop from 6 percent to 5 percent as costs take a greater toll than previously anticipated, Autonews Europe reports.

Adding insult to injury is the management crisis at the very top of the company. Renault is currently looking for a new CEO after firing Thierry Bolloré and appointing Clotilde Delbos as interim chief earlier this month.

In the past year, Renault has also been affected by the arrest of former CEO Carlos Ghosn in Japan, with the case exposing unresolved tensions with alliance partner Nissan. Since then, Nissan has vetoed a plan for Renault to merge with Fiat Chrysler Automobiles. The Japanese automaker is not doing great itself either, facing a slide in profits and mass job cuts. This also indirectly affects Renault, which owns a 43.4 percent stake in Nissan.