- A new study reveals that connectivity issues have turned off some owners from using these apps.

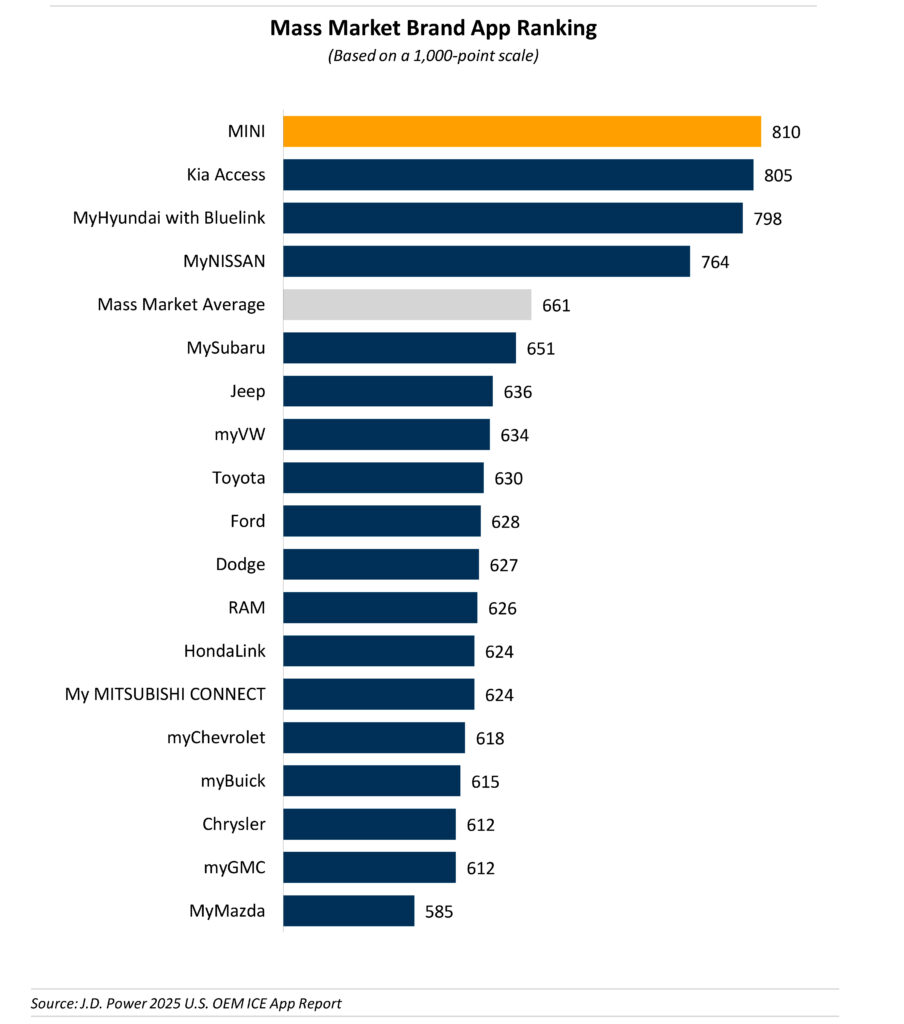

- Mini took out top place for customer satisfaction for mass-market brands with smartphone apps.

- 61 percent of app users want to be able to control their garage doors from their phone.

As cars become more digitally integrated, it’s no surprise that more drivers are turning to official smartphone apps to manage their vehicles. For internal combustion engine (ICE) owners, these apps promise added convenience, like remote features, real-time updates, and a smoother ownership experience overall.

At least on paper, because a new study shows that while adoption is on the rise, the reality doesn’t always live up to the promise.

Read: Mobile Apps For EVs Are Pretty, But Struggle To Impress Users Where It Matters Most

The findings come from a survey of more than 2,100 ICE owners in the USA, conducted by JD Power between September and October. Participants were asked about their experiences using their vehicles’ official smartphone apps, shedding light on where these tools meet expectations, and where they still fall short.

According to to the latest OEM ICE App Report from, nearly 80 percent of gas vehicle owners in the States have used their car’s companion app. That’s a modest two-point increase from 2024, indicating steady, if slow, growth.

Despite the high rate of exposure, only 27 percent of respondents said they use their app frequently, which is defined as every time or more than half the time they drive. That leaves a significant majority who either use it occasionally or not at all, underscoring a gap between potential and actual utility.

What Do Owners Want From Their Apps?

Among those who do use their apps, the most sought-after feature is a garage door opener, cited by 61 percent of users. Another 39 percent said they value the ability to use their smartphone as a digital key, while 38 percent prioritized control over heated and cooled seat settings.

Remote locking and unlocking features were used by 34 percent of respondents, while 31 percent made use of trunk control features. These figures suggest that when the app works, drivers do find value in it, just not necessarily across the board.

When Tech Gets in the Way

That value erodes quickly when things don’t work as expected. Of the 38 percent who said they’ve stopped using their app altogether, most pointed to connectivity issues as the main culprit.

Unintuitive design and unreliable remote start functions were flagged by 14 percent of respondents, along with sluggish response times and erratic feature performance. These pain points appear to be key reasons for the drop-off in regular use.

JD Power’s study also found that 5 percent of users are concerned with the lack of desired features, 4 percent cited outdated or inaccurate information as pain points, and 4 percent said there were difficulties in managing multiple users.

Who’s Getting It Right?

Among mass-market carmakers offering mobile apps, Mini earned the highest marks for customer satisfaction, scoring 810 out of 1,000. It was followed by Kia with 805 and Hyundai with 798.

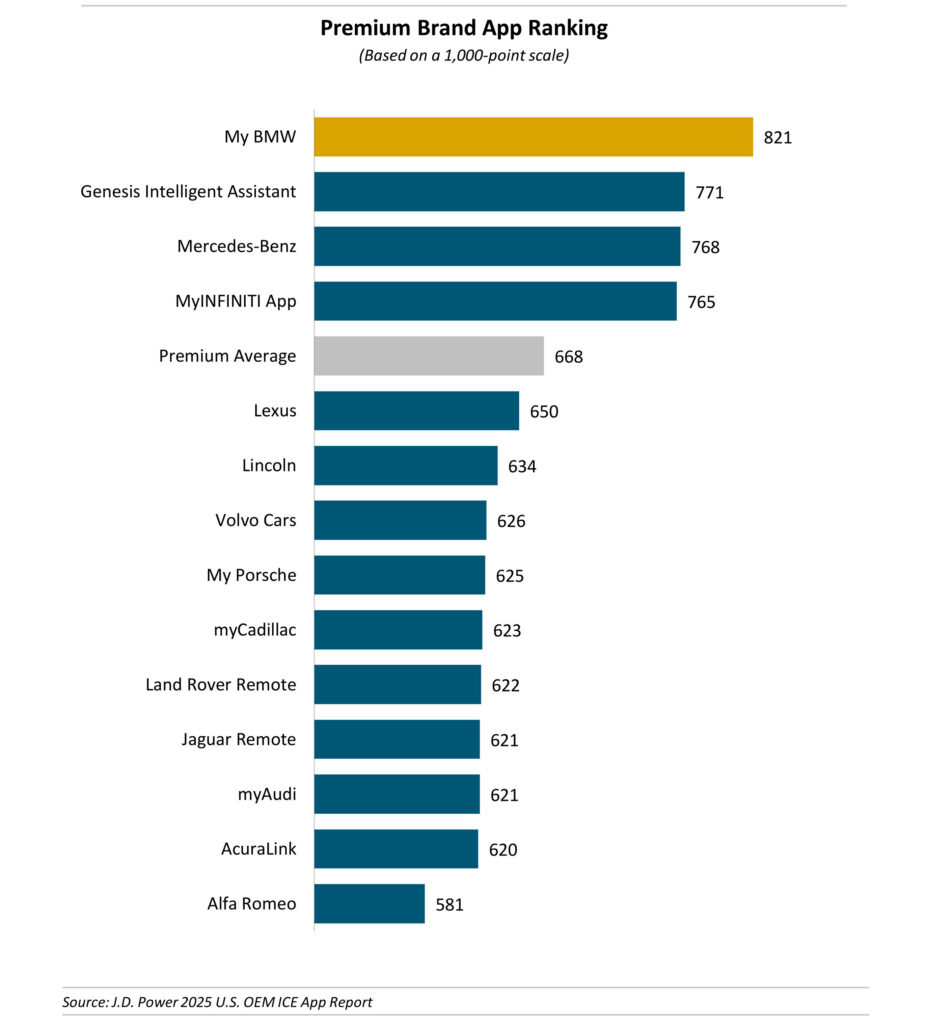

In the premium category, BMW led with a score of 821, placing it at the top overall, regardless of segment. Genesis followed with 771, while Mercedes-Benz came in just behind at 768.

At the other end of the scale, Mazda landed at the bottom among mainstream brands with a score of just 585. GMC and Chrysler fared only slightly better, each scoring 612. In the premium segment, Alfa Romeo recorded the lowest score overall at 581.