- Toyota and Lexus dealers barely have time to dust cars.

- Jeep and Ram lots resemble metal retirement communities.

- Inventory falls overall but pricier cars actually move faster.

Looking for a really hot deal on a new car? Maybe give your Toyota and Lexus dealers a miss and hit up one of the Stellantis brands, because they’ve got stock coming out of their ears and must be keen to get some metal moving.

That’s our read on a fresh report from Cox Automotive highlighting the huge differences in new vehicle inventory across the US car industry in the final month of 2025.

Related: Dodge Sales Crashed In 2025, Yet Its Failed Charger EV Outsold Fiat And Alfa Combined

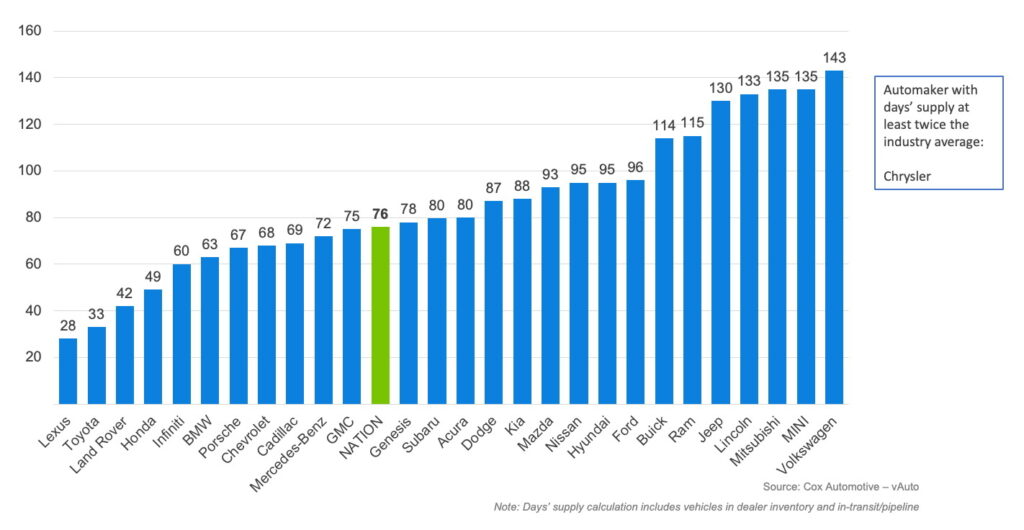

The headline number from Cox is that total US inventory finished December at about 2.77 million vehicles. That works out to a 76 day supply, down sharply from 92 days and 3 million cars only a month earlier.

Strong year end sales helped clear a lot of 2025 models and left many dealers entering January with far leaner lots than expected.

Winners and Stragglers

But dig a little deeper and the picture gets wildly uneven. Toyota and Lexus remain the US champions of inventory management, turning vehicles almost as fast as they arrive. Lexus averaged just 28 days of supply and Toyota sat at 33.

Land Rover is next with 42 days and Honda’s 49-day total puts it close behind. These brands have mastered the art of keeping production matched to real demand.

More: Honda Reveals Prelude Sales Target. If It Delivers, It May Outsell The BRZ

At the other end of the industry parking lot, things are very different, and very crowded. Jeep closed the year with roughly 130 days of supply, while Ram trucks piled up at about 115 days. Chrysler somehow managed to look even worse.

Lincoln, Mini and Mitsubishi also struggled with more than 130 days on hand, each and VW – whose US sales are in a hole – has a massive 143 days’ supply. For those brands, December looked less like a sales celebration and more like a storage crisis.

December Days’ Supply of Inventory by Brand

Big Price, Smaller Stock

Pricing adds another strange twist. The average new vehicle listing price climbed to just over $50,000 even as affordability worries grow louder. Luxury vehicles above $75,000 thousand dollars actually moved fast, while sub-$40k vehicles lingered on lots, suggesting budget buyers are simply staying home.

Read: Luxury Sales Keep Surging As The Middle Class Quietly Gets Priced Out

All of which means there are deals to be had, but not across the board. If you are interested in a VW or Stellantis car, though, and want to take it right away rather than put in a custom order, at least you’ll have plenty to choose from.